A poor earnings report happens to the best of companies. However, in the case of EV manufacturer Rivian Automotive (NASDAQ:RIVN), its latest poor print reflects a cruel reality: the sector’s low-hanging fruit has likely already been picked. Looking ahead, the company must compete in an increasingly competitive and desperate arena, which is not ideal for a struggling business. I am bearish on RIVN stock due to mounting skepticism for a recovery.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Q4 Print Reveals the Honeymoon Is Over for RIVN Stock

When Rivian first entered the public domain, the company’s fresh take on electric-powered mobility and the provision of a consumer and investment alternative to Tesla (NASDAQ:TSLA) attracted market participants. However, RIVN stock quickly struggled to maintain positive momentum. Unfortunately, the EV maker’s latest earnings report suggests that any honeymoon period is long gone.

On Wednesday, management reported a loss per share of $1.58, comparing unfavorably to the consensus target of a loss of $1.35 per share. Still, it was an improvement on a year-over-year basis when Rivian suffered a per-share loss of $1.87. Also, on the top line, the EV manufacturer posted sales of $1.32 billion, beating analysts’ expectations of $1.28 billion.

Adding to the good news, Rivian’s production and deliveries increased by 75.1% and 73.5%, respectively, on a year-over-year basis. Unfortunately, the market took a dim view of the forward outlook. Specifically, management expects a 10% to 15% sequential fall in total deliveries in Q1. As well, Rivian only sees total vehicle production for this year at 57,000 units compared to last year’s tally of 57,232.

While representing a conspicuous alternative to Tesla, it’s also quite evident that the cost structure for the EV industry is simply mismatched with current consumer economic dynamics. Right now, the cheapest Rivian consumers can get their hands on is the R1T pickup truck, which starts at nearly $72,000.

Yes, beating the quarterly sales target is a good step. However, in an environment saddled with consumer headwinds and a full-blown sector price war, investors need to see a viable path to profitability. They didn’t get it, and the disappointing forward outlook didn’t help matters.

Only High-Hanging Fruit Remains for Rivian Automotive

Moving forward, it’s possible that only the high-hanging fruit remains for Rivian to attempt to pick. The problem here is that even in the higher-income category, premium-level EV manufacturers can’t depend on a more affluent consumer base to open its wallet.

One just needs to look at the earnings report by Rivian competitor Lucid Group (NASDAQ:LCID). Much like Rivian, Lucid competes in the premium category but to a much greater degree. Theoretically, this narrative should have panned out well for LCID. Roughly two years back, I thought that Lucid’s focus on the wealthy demographic was the right business move. Sadly, a quick look at the chart reveals that this narrative simply did not pan out.

More than likely, those who were in the market for a high-five-digit EV (or pricier) have already bought one. Moving forward, companies like Rivian need to target the middle-income crowd. However, that’s where circumstances may get tricky for RIVN stock. If it’s already struggling having enjoyed a head start compared to legacy automakers pivoting to electrification, then a fully-blown competitive atmosphere would likely be even more problematic.

Fundamentally, legacy automakers should enjoy superior economies of scale. Not only that, but combustion-powered cars remain popular for a variety of reasons, cost included. Moreover, with winter weather leaving many EV drivers stranded in the cold, many folks are undoubtedly rethinking their willingness to jump aboard the EV train.

Finally, investors must also consider that for millions of customers, they will need public charging infrastructure if they make the switch. While a majority of occupied housing units in the U.S. had a garage or carport in 2017, about 34% did not. That’s a lot of consumers that may not want to transition, given the public challenges that the sector has faced.

Options Traders Are Skeptical

While questionable fundamentals leading to poor sentiment in the open market is one thing, it’s quite another when the big money decides to take bets against the target security. That appears to be the case with RIVN stock, thus warranting extreme caution.

Specifically, options flow screeners – which filter exclusively for big block transactions likely placed by institutions – reveal significant volume of significantly bearish bets. Last Friday, traders sold 42,806 contracts of the RIVN May 17 ’24 12.50 Call, along with the selling of 30,607 contracts of the Mar 28 ’24 10.00 Call. Premiums received for these two options came out to $849,015 and $1.09 million, respectively.

In addition, major entities bought put options, including 14,464 contracts of the Mar 1 ’24 10.00 Put and 18,095 contracts of the Oct 18 ’24 7.50 Put. These are only a handful of the wagers placed against RIVN stock, which effectively summarizes the narrative: astute traders don’t see much upside beyond $12.50 and have serious concerns that RIVN stock could drop to $7.50 or even lower.

Is RIVN Stock a Buy, According to Analysts?

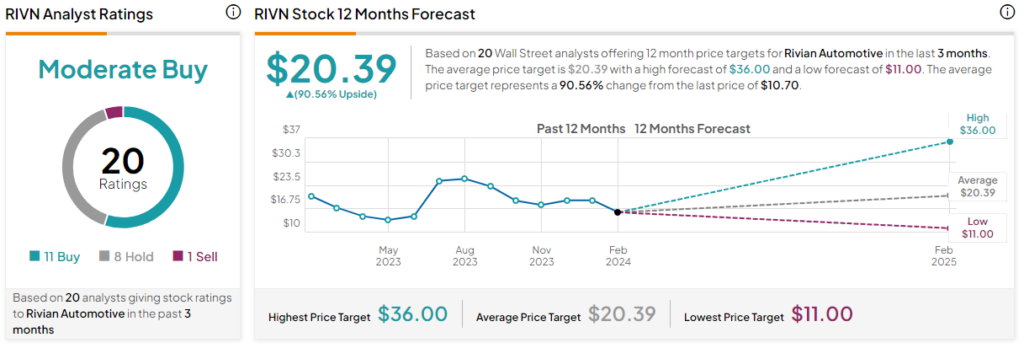

Turning to Wall Street, RIVN stock has a Hold consensus rating based on 11 Buys, eight Holds, and one Sell rating. The average RIVN stock price target is $20.39, implying 90.6% upside potential.

The Takeaway: RIVN Stock Suffers from a Major Credibility Overhang

Although Rivian Automotive’s latest earnings report had many positives, investors are a forward-looking bunch. Unfortunately, management’s projections didn’t offer much room for optimism, especially in a pressured environment for the consumer. With even wealthy folks stepping back their purchases, it appears that Rivian must address the high-hanging fruit. However, the smart money apparently doesn’t see that narrative as likely, leading to bearish bets against RIVN stock.