Are hard times ahead for the automotive industry? The supply chain crunch of recent years has resulted in empty dealer lots and long wait times for customer orders – a classic case of undersupply. However, now the electric vehicle (EV) market faces pressure from oversupply. Governmental subsidies have boosted production, while EV sales are hindered by challenges such as low battery range and often inadequate charging networks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The political and social will exists to push EVs to the forefront of the auto industry, but as this month’s harsh winter weather showed, EV technology may not be quite as ready as manufacturers would like. Consumers have noticed, and dealers are reporting an excess of EVs piling up on lots and showroom floors.

Analyst Adrian Yanoshik, from Redburn, is cautious about the immediate future of automotive stocks, particularly in the EV market. He writes, “Our work highlights that supply growth is exerting more pressure on electric vehicle (EV) pricing than many investors have considered. Market share instability has risen in the US, while China is consolidating slightly after extreme competition in recent years. We argue that EV pricing pressure may continue until demand, possibly at a stall point along a technological adoption ‘s-curve’, catches up with greater EV availability.”

Against this backdrop, Yanoshik has taken the step of initiating coverage on two big-name EV stocks, (NASDAQ:TSLA) and Ford (NYSE:F), with ‘Sell’ ratings. We ran both tickers through TipRanks’ database to discover what makes them worth avoiding.

Tesla

We’ll start with Tesla, Elon Musk’s flagship business – one of the few pure-play EV companies that has turned a profit. Tesla’s high-end vehicles have won accolades for styling and performance. The company’s success in sales and marketing is evident from its delivery numbers; Tesla delivered 1.808 million vehicles to customers last year, marking a year-over-year increase of nearly 38%.

However, Tesla is not solely focused on building aesthetically pleasing cars. The company has also made a significant commitment to an extensive US manufacturing network. Tesla’s primary vehicle assembly plant is located in Fremont, California, where it produces the Tesla Model S, Model 3, Model X, and Model Y electric vehicles. In addition to this, the company has factories in Texas, Nevada, and New York. The Texas facility serves as Tesla’s headquarters and houses assembly lines for the Model Y and the Cybertruck. The Nevada plant specializes in building electric motors, powertrains, and batteries, while the New York facility handles solar roofs and other electrical components. Furthermore, Tesla has established factories abroad, with locations in Shanghai and Berlin.

One of the innovative technologies used in Tesla’s cars is the unique – for the auto industry – cylindrical battery cells. These cylindrical cells can be produced on a faster timeline than traditional battery packs, leading to more efficient factory utilization and more kilowatt-hours of battery capacity available for every dollar invested. Additionally, the cylindrical cells offer advantages in terms of charging time and range per charge.

Turning our attention to the most recent quarter, Q4 saw Tesla deliver 484,507 vehicles, resulting in a total revenue of nearly $25.17 billion. Although this represented a 3% year-over-year growth, the revenue figure fell short of expectations by $590 million. In terms of earnings, the company reported a non-GAAP diluted share value of 71 cents for the fourth quarter, marking a 40% year-over-year decrease and coming in 3 cents below projections. Tesla’s management has also indicated that the expected growth in vehicle volume for 2024 is likely to decelerate significantly compared to recent years.

Checking in with the Redburn view, we find analyst Yanoshik pointing out that Tesla will face pressures from both pricing and oversupply, while dealing with an increased need for capex in the near future.

“Pricing – amid increasingly oversupplied EVs – will dominate any margin benefit from lower commodity prices in the coming quarters, in our estimation. We expect Tesla to prioritise volumes over price, but with the monetisation of its growing fleet only beginning from 2025. Meanwhile, to support its leadership position Tesla will invest significantly in AI and in building EV capacity ahead of new vehicle launches. This higher investment intensity may further pressure FCF, where our estimates sit materially below consensus,” Yanoshik opined.

These considerations informed the analyst’s reticence on the stock, and he continued by explaining his lack of enthusiasm for Tesla shares: “We launch with a Sell recommendation, flagging that our call is most at risk if Tesla introduces a compelling next-generation model with a viable start of production within 18 months of announcement. However, we find such an outcome challenged by new production technology (including battery cells) and a difficult Cybertruck ramp-up.”

Yanoshik’s Sell rating comes alongside his $170 price target, a target that implies a potential downside risk of 15% for TSLA in the next 12 months. (To watch Yanoshik’s track record, click here)

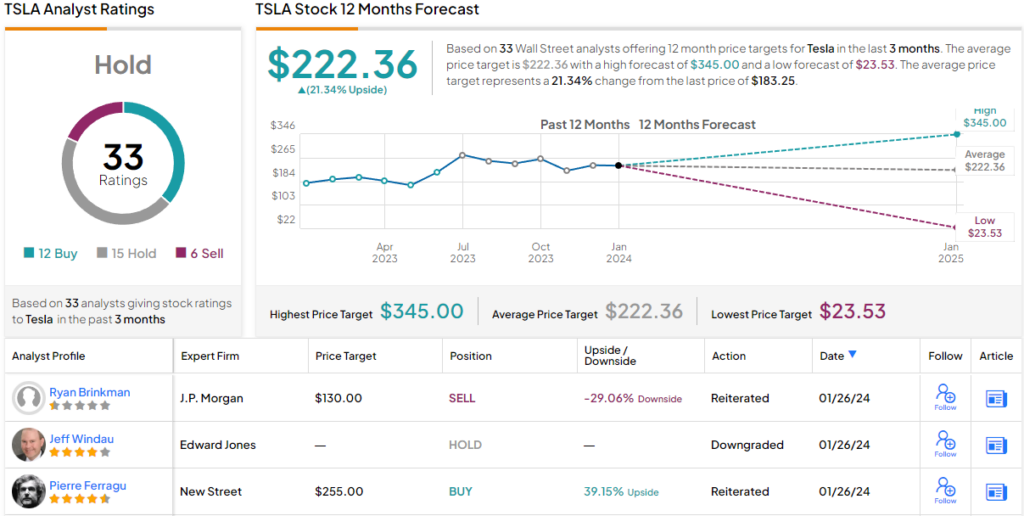

What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 12 Buy ratings, 15 Holds and 6 Sells add up to a Hold (i.e. neutral) consensus rating. In addition, the $222.36 average price target indicates 21% upside potential. (See Tesla stock forecast)

Ford Motor (F)

The second stock on our list is one of Detroit’s legendary names. Based in Dearborn, Michigan, and long associated with the Motor City, Ford Motor has been making industrial waves from its earliest days. Under Henry Ford’s leadership in the early 1900s, the company developed the modern industrial assembly line and introduced the first low-cost, mass-produced automobiles. Ford has always had a good feel for what its customers want, and its F-series light- and heavy-duty pickup trucks have, for decades, been among the best-selling vehicles in the US car market.

But what really stands out is Ford’s commitment to electric vehicles (EVs). During the fall of 2021, Ford Motor Company announced an $11.4 billion, multi-year investment program in electric vehicles, a plan that included factory floor modernization, new vehicle design, and plenty of research and development in EV technology. Ford pushed hard to develop electric models of two of its best-selling vehicles, the F-150 pickup and the classic Ford Mustang.

In its last vehicle sales update, for the full year 2023, the company showed that it has been working to deliver EVs to the public. Ford sold a total of 72,608 electric vehicles last year, of which 25,937 were sold in Q4. These numbers were up 18% and 24%, respectively, over the comparable 2022 figures; that growth was powered by sales of the F-150 Lightning and the Mustang Mach-E models. In addition, but on a more modest scale, Ford’s electric delivery van, the E-Transit, was the best-selling electric van nameplate in the US in 2023, with total sales of 7,672 for an 18% year-over-year increase.

On the negative side, Ford’s EV program is a money loser. The company faces higher costs in raw materials, consumer demand that is not meeting projections, and a loss of approximately $4 billion in its EV segment for the full year 2023. In an announcement earlier this month, which underscores this point, the company revealed that it is cutting production of the F-150 Lightning series. At the same time, Ford is adding 900 jobs to create a third work crew at the Michigan Assembly Plant, in Wayne, MI, in order to boost production of the gas-powered Bronco and Ranger lines, which have both proven to be popular with customers.

In its last quarterly financial release, from 3Q23, Ford showed year-over-year increases at the top and bottom lines while also missing analyst expectations. Revenue, excluding the Ford Credit division, came to $41.17 billion; this represented a 10.7% year-over-year increase but was $1.33 billion less than had been anticipated. The bottom-line earnings figure, the non-GAAP diluted EPS, was 39 cents; this compared favorably to the 30 cents reported in the prior-year quarter but was 7 cents per share below the forecast.

In his notes on Ford, Redburn’s Yanoshik brings attention to both the strengths and weaknesses of the company’s push into EVs, writing, “The company’s early launch of compelling nameplates and disclosure of EV segment (Model e) KPIs, including margins, have improved electrification transparency. However, our review of Ford’s underlying cost structure suggests minimal improvement until it develops a deeper EV platform – we expect the group to underperform its peers in this regard over the next two years. Greater investment will be needed to catch up, coinciding with demand pressure across the business.”

The analyst goes on to explain why this stock deserves a ‘Sell’ rating: “The company’s solid position in pickups, typically a strength, enhances its cyclical exposure. Costs face headwinds from a new labour agreement and the need to increase build quality to respond to rising warranty charges. Alongside a premium relative valuation, we remain cautious on shares and launch with a Sell rating.”

Yanoshik’s Sell rating for Ford is accompanied by a price target of $10, indicating a potential downside of 12% over the next year.

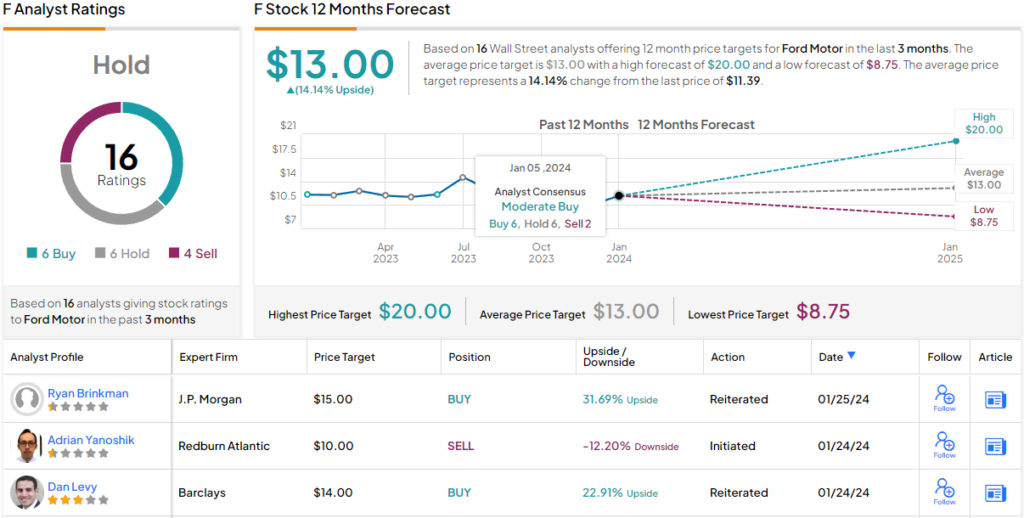

All in all, Ford shares have picked up 16 recent analyst reviews, and these include 6 Buys, 6 Holds, and 4 Sells, for a Hold consensus. The shares are priced at $11.39 and their $13 average price target implies a share appreciation of 14% by the end of this year. (See Ford stock forecast)

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.