There were plenty of analysts who were downright baffled at the meteoric rise of Vietnamese electric vehicle stock VinFast (NASDAQ:VFS). It was called everything from “unsustainable” to “insane,” and over the last few days, the market has reasserted sanity. Indeed, in Friday morning’s trading, VinFast lost another 20%, sending share prices down roughly 70% from their highs of just a few days ago.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At its height, VinFast had a market cap that was approximately the same as IBM (NYSE:IBM). It’s since fallen off dramatically, but value-wise, it’s still in the same ballpark as the likes of General Motors (NYSE:GM) and Ford (NYSE:F). It’ll need that value, as it has some pretty major plans ahead of it. Ultimately, it wants to compete with Tesla (NASDAQ:TSLA), which is pretty much what every electric vehicle maker these days has to do. To that end, it’s already started construction on a factory in North Carolina. Said factory should open in 2025 and, when complete, should roll out 150,000 vehicles annually. If it can find buyers for all those vehicles, it should do reasonably well.

With the dust surrounding the frenzy finally starting to settle—though it’s a safe bet that VinFast still has some downward pressure to vent off—analysts are seeing better value. But only seeing it; it really hasn’t arrived. With VinFast only selling 24,000 cars last year and posting a loss of over $2 billion despite revenue of $634 million, it’s clear that VinFast was not worth anywhere near what IBM was. Being worth what longstanding greats like Ford and GM are is probably also a bridge too far.

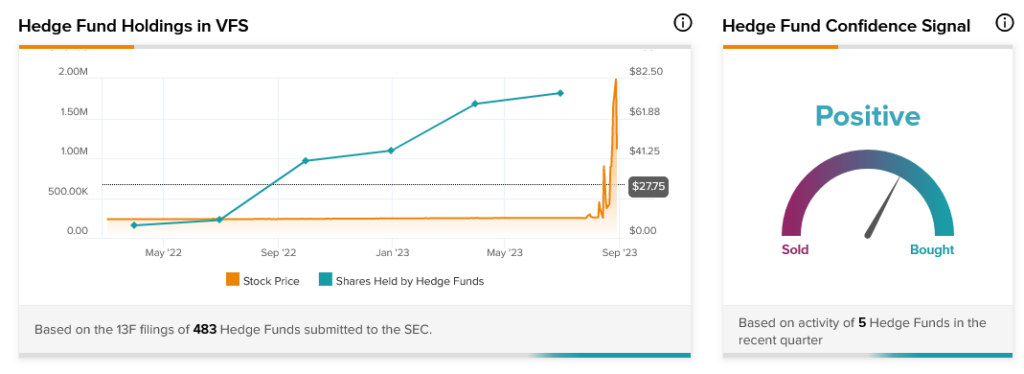

Prior to the company going public, hedge funds were increasing their stakes in VinFast and bought an extra 134,300 shares in the last quarter, which was enough to tip hedge fund confidence to “Positive.” However, it’s easy to wonder how much longer that will last in light of the recent plunges. Indeed, these institutional investors are likely the ones who were cashing in at higher prices.