PNC Financial (NYSE:PNC) stock fell about 2% yesterday after the company released mixed first-quarter results. The company’s performance was impacted by higher interest rates and a slowdown in commercial loan demand. However, a decline in credit loss provisions and core expenses supported the results to some extent.

PNC is a diversified financial services company offering banking, lending, investment, and wealth management services.

PNC: Q1 Highlights

The company posted adjusted earnings of $3.36 per share, which exceeded analysts’ estimates of $3.01 per share. However, the reported figure declined by 15.6% from the prior-year quarter.

Meanwhile, Q1 revenues of $5.15 billion fell by 8.2% year-over-year and missed the Street’s estimates of $5.19 billion. The decrease can be attributed to a 9% decline in net interest income. Also, non-interest income declined by 7%, primarily due to lower residential and commercial mortgage income.

Meanwhile, PNC’s core non-interest expense declined by 4% to $3.2 billion.

In terms of credit quality, provision for credit losses declined 80% year-over-year to $155 million. However, net loan charge-offs and nonperforming loans rose by 25% and 18%, respectively.

PNC Provided Soft Q2 Outlook

PNC expects Q2 total revenue and average loans to remain stable sequentially. Also, the company anticipates that NII will fall 1% from the previous quarter, while fee income will rise between 1% and 2%.

Moreover, core non-interest expenses are projected to increase in the range of 2% to 4% year-over-year.

Is PNC a Good Stock to Buy?

Following the release of Q2 earnings, a five-star analyst from Citi, Keith Horowitz, reiterated a Buy rating on PNC Financial stock. Also, the price target of $175 implies an upside potential of 19.4% from the current level.

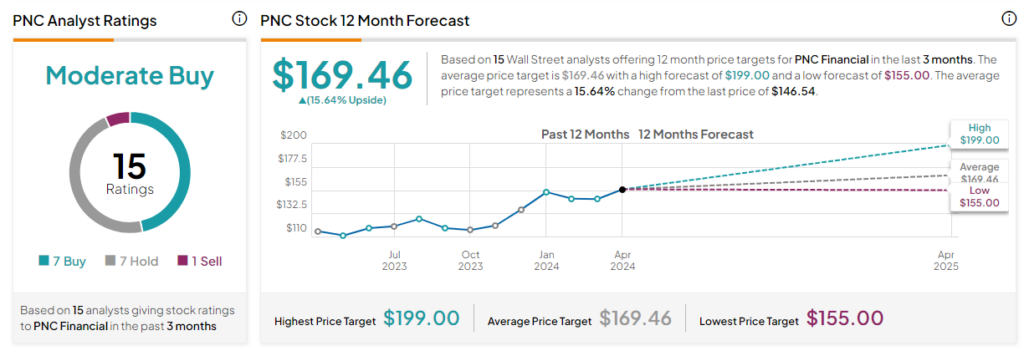

Overall, Wall Street is cautiously optimistic about PNC stock. It has a Moderate Buy consensus rating, based on seven Buy, seven Hold, and one Sell recommendations. After a surge of more than 25% in its stock price over the past six months, the analysts’ average price target of $169.46 implies a 15.6% upside potential from current levels.