PayPal (NASDAQ:PYPL) stock struggled to sustain any sort of strength in 2023, a year that saw tech climb out of a funk and charge to new highs on the back of the artificial intelligence (AI) boom. Undoubtedly, PayPal stock is close to the cheapest it’s ever been, presenting deep value, with shares hovering off more than 80% from their mid-2021 peak.

Of course, the former fintech darling needs some sort of “killer” catalyst to turn the tide. Though it has some stake in the AI game (some intriguing AI products were showcased earlier this year), many investors and analysts remain skeptical. Just because management thinks new features like “smart receipts” are game-changing doesn’t mean anybody else on Wall Street does.

Given jaw-dropping technology like OpenAI Sora and ChatGPT-4 Turbo, it’s not a mystery as to why something as simple as “smart receipts” failed to garner hype in a market that continues to give anything AI-related a huge round of applause. Only time will tell what helps PayPal sustain positive momentum, but the main attraction to the shares, I believe, is its valuation. As such, I am staying bullish.

PayPal Stock’s Getting Cheap, Perhaps Too Cheap.

At 15.4 times trailing price-to-earnings (P/E) and 11.4 times next year’s expected P/E, PayPal goes for a fraction of what it used to command during its hot 2020-21 run. Even if it’s become more of a challenge to grow in a payments market that’s now crowded, I think there are ways that the company can use technology to hold its ground.

Undoubtedly, payment platforms aren’t as innovative as they used to be, with so many options, including installment-based payment plans, for digital shoppers to choose from. Some big change is needed if PayPal is to regain a fraction of the glory it commanded just two and a half years ago. As PayPal embraces new tech (think generative AI and cryptocurrencies) while being open to evolving through potentially transformative moves, I’ll continue to view the name as more of a deep-value play that’s worth the wait.

For now, many investors have moved on to hotter and better things in the tech scene. However, that’s exactly what entices me about PayPal at these depths. What could turn the tides over at PayPal? Let’s look at two potential factors that could help the stock make up for lost time over the coming years.

New AI Features are Great, But PayPal Needs to Go the Extra Mile

A large reason why PayPal stock didn’t pop after its latest AI-driven feature showcase, I believe, is because it lacked something that helped differentiate the firm. The payments space has become very crowded, and with many threats in the scene that are also embracing generative AI with open arms, AI features seem more like something to “keep up” rather than “pull ahead” of peers in the industry.

AI features similar to PayPal’s smart receipts, or CashPass, are replicable by rivals. This begs the question, how can PayPal offer something truly unique that rivals can’t counter so easily?

There are plenty of AI innovations brewing within PayPal Ventures, including large language models (LLMs) that could help it gain ground in the consumer-facing chatbot game. PayPal’s recent $30 million stake in AI startup Rasa may have gone under the radar. However, it’s moves like these that could help bring the innovative shine and unique appeal back to the firm.

As PayPal makes the right moves in the AI waters, I do think it has what it takes to regain the edge. Perhaps the company’s next AI showcase could move the needle higher on the stock as it looks to double down in AI innovation in an attempt to get ahead of the pack.

PayPal: An Acquisition Could Help the Firm Pivot

Over the years, I believe PayPal has made some very smart bite-sized deals, including the acquisition of Honey, a browser extension that makes it all too easy for shoppers to clip coupons. Looking ahead, I’d look for PayPal to wheel and deal to gain relevance again and bring in more cherished tools, platforms, and talent in an effort to spruce up its highly underrated ecosystem.

Such small-scale deals, while nice additions, haven’t been a game-changer for PayPal, though. To get the attention of Wall Street, PayPal may need to swing for the fences with its next major acquisition. Undoubtedly, PayPal could really use such a transformative pivot to spice things up. Perhaps the firm should seek out a deal in the realm of social media or e-commerce to give payments a shot in the arm.

For now, some analysts seem to be losing confidence in PayPal stock as it struggles to grow. Daiwa Capital Markets recently downgraded the stock to Hold from Buy over its hazy growth potential. A sizeable acquisition may just be able to raise PayPal’s growth ceiling.

Is PayPal Stock a Buy, According to Analysts?

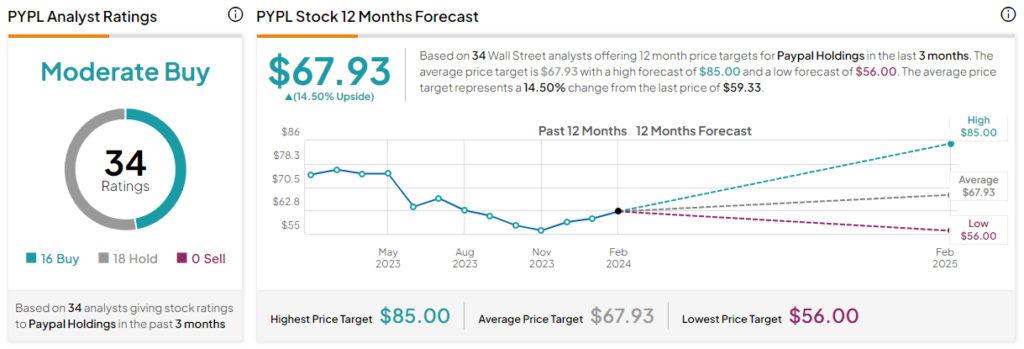

On TipRanks, PYPL stock comes in as a Moderate Buy. Out of 34 analyst ratings, there are 16 Buys and 18 Hold recommendations. The average PYPL stock price target is $67.93, implying upside potential of 14.5%. Analyst price targets range from a low of $56.00 per share to a high of $85.00 per share.

The Bottom Line

Block (NYSE:SQ) stock’s recent 16% pop suggests there’s still life in the payments scene, as Cash App saw gross profits surge 25% year-over-year. Only time will tell if PayPal’s Venmo can gain similar traction this year. Regardless, I view Venmo as an impressive foundation for future growth, with its sizeable installed base to lean on. Perhaps a big acquisition could help bring back the heat to PayPal stock as it looks to innovate its way back to the top.