Fintech giant PayPal (PYPL) is scheduled to announce its third-quarter earnings on October 28. PYPL stock has declined 18.3% year-to-date. While there is optimism about the company’s vast network and continued shift to digital payments, many analysts are cautious about PayPal stock due to significant competition and macro uncertainties. Wall Street expects PayPal to report earnings per share (EPS) of $1.20, in line with the prior-year quarter’s bottom line.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, revenue is expected to rise 5% year-over-year to $8.24 billion. PayPal has exceeded the Street’s earnings expectations for five consecutive quarters.

Investors will look forward to more details on the company’s recently announced collaboration with Google’s parent Alphabet (GOOGL) as well as the prospects for its newly launched PayPal Ads Manager, an advertising platform to help merchants turn their online traffic into revenue.

Analysts’ Views Ahead of PayPal’s Q3 Earnings

Earlier this month, Citizens analyst Andrew Boone reiterated a Hold rating on PayPal stock with a price target of $100. The 5-star analyst views PayPal Ads as a medium-term opportunity as the company builds out partnerships. He expects the ramp in advertising revenue to contribute significantly to the overall bottom line.

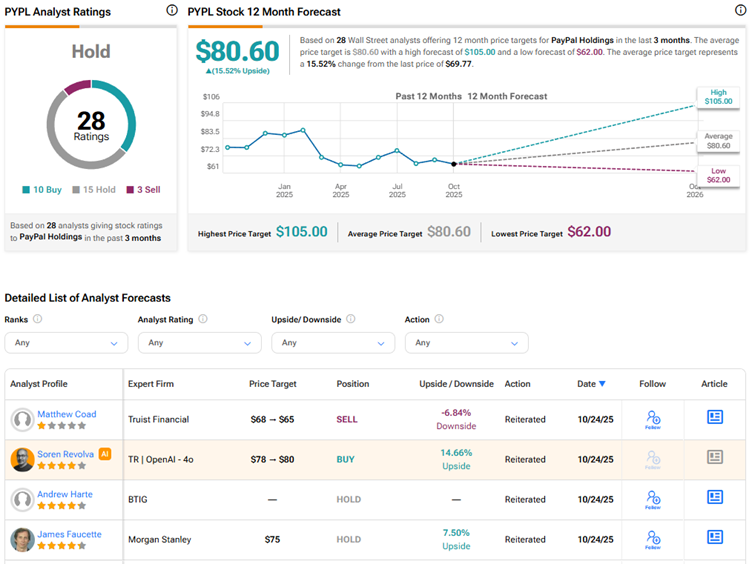

Meanwhile, Truist analyst Matthew Coad lowered his price target for PayPal stock to $65 from $68 and retained a Sell rating in a preview note on Q3 earnings of the companies in the payments and fintech space. While Coad expects Q3 results to be strong as consumer spending has held up well, he is concerned that the Q4 outlook for certain firms may be worse than the Street’s expectations due to tougher comparisons following the strong holiday spending last year. The analyst cautioned that investors should be selective when investing in the payments and fintech space.

AI Analyst Is Bullish on PayPal’s Stock Ahead of Q3 Print

Interestingly, TipRanks’ AI Analyst has assigned an Outperform rating to PayPal stock with a price target of $80, indicating about 14.7% upside potential. TipRanks’ AI analyst’s rating is based on solid financial performance and a positive earnings call. It also highlighted that PayPal’s strategic initiatives and innovation in areas like Venmo and BNPL (buy now, pay later) support its growth trajectory.

Also, technical analysis and valuation provide a balanced view, with mixed signals and a reasonable valuation.

Options Traders Anticipate a Major Move on PayPal’s Q3 Earnings

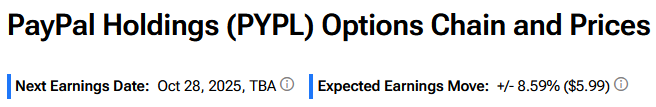

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about an 8.6% move in either direction in PYPL stock in reaction to Q3 FY25 results.

Is PYPL a Good Stock to Buy?

Overall, Wall Street has a Hold consensus rating on PayPal Holdings stock based on 10 Buys, 15 Holds, and three Sell recommendations. The average PYPL stock price target of $80.60 indicates a 15.5% upside potential from current levels.