PayPal (PYPL) stock climbed 5% on Tuesday after the company disclosed plans to step into the advertising market with a new tool for small businesses. The payments giant revealed PayPal Ads Manager, a new advertising platform to help merchants turn their online traffic into revenue, without needing a marketing team or technical know-how.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The platform is expected to launch in early 2026 in the U.S., followed by rollouts in the UK and Germany.

Unlike complex, costly traditional platforms, PayPal Ads Manager requires businesses to simply opt in and integrate a simple SDK (software development kit) within minutes. Once set up, merchants can display targeted ads on their websites, choose which advertisers appear, and track performance, from their existing PayPal Merchant Portal.

Also, small businesses will gain access to PayPal’s Storefront Ads solution for cross-channel campaign management. This will allow them to run and manage advertisements across platforms from a single dashboard.

PYPL Levels the Playing Field for Small Businesses

A key feature of the Ads Manager is its reliance on PayPal’s vast transaction data, spanning 430 million consumers across more than 200 markets. This allows advertisers to target consumers based on their actual buying behavior rather than less reliable browsing history, offering a powerful tool for retail media.

Importantly, this gives small businesses access to the kind of high-margin ad models typically reserved for retail giants like Amazon (AMZN) and Walmart (WMT).

Mark Grether, SVP and General Manager of PayPal Ads, said, “We’re enabling small businesses to participate in the same advertising model that’s powering growth at some of the largest companies in the world.”

Is PayPal a Buy, Sell, or Hold?

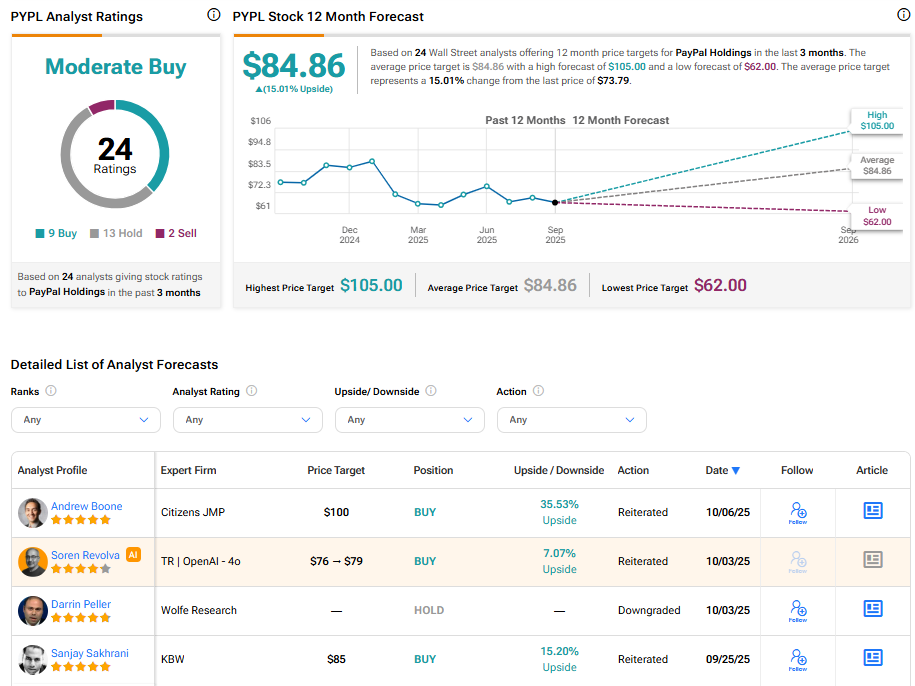

Turning to Wall Street, PYPL stock has a Moderate Buy consensus rating based on nine Buys, 13 Holds, and two Sells assigned in the last three months. At $84.86, the average PayPal stock price target implies a 15.01% upside potential.