Is it a recovery or a dead cat bounce? Whatever it was, it was a brief ray of hope for PacWest Bancorp (NASDAQ:PACW) investors. Brief, of course, because it didn’t last long. While PacWest was up 2.8% in Friday’s premarket, by Friday afternoon, it lost all those gains and is down over 2% at the time of writing.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

PacWest lost a lot more ground than that in Thursday afternoon’s trading session, down around 23% after it noted that its deposit volume was down about 10% since First Republic Bank (OTHEROTC:FRCB) failed back on May 1. Between it, Silicon Valley Bank, and others, the issue of trust in the overall banking system–particularly regional banks–has reared its ugly head more than once. Banks are paying the price as a result.

Oanda senior market analyst Ed Moya noted that, indeed, PacWest was starting to “…look like the weakest link,” which would pose a serious problem for investors. Worse yet, word also emerged that PacWest was considering strategic alternatives, which means a sale might be possible. However, Moya also noted that PacWest had no shortage of cash, which meant it might be able to just ride out the turbulence the banking industry sees itself in right now. With $15 billion in ready cash and $5.2 billion in uninsured deposits, it could comfortably survive the loss of all deposits.

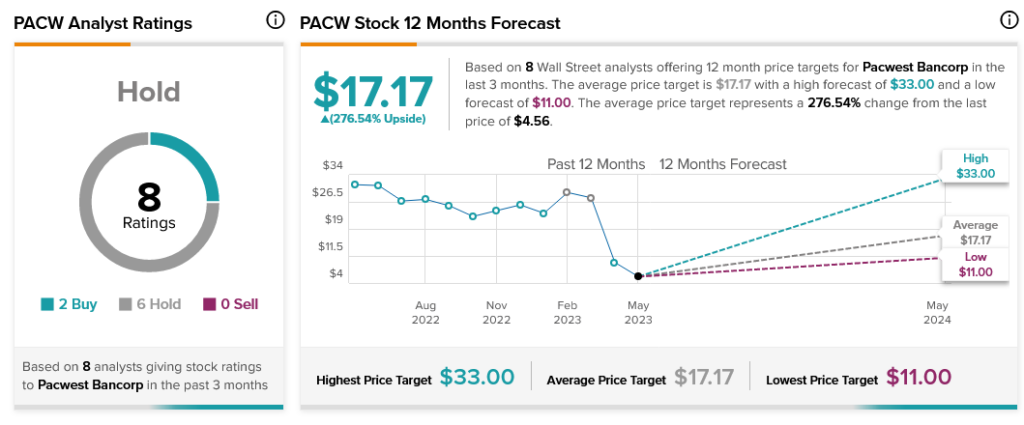

“Riding out the storm” seems to be popular with analysts, too. Currently, analyst consensus calls PacWest stock a Hold, with two Buy ratings and six Hold ratings. Further, PacWest stock offers investors 276.54% upside potential, thanks to its average price target of $17.17.