It’s Tuesday afternoon, and the ledgers run green with the ink of regional bank stocks. Several such stocks are up this afternoon as contrarian voices have emerged that suggest that it’s time to buy in.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Regional bank stocks have been making a comeback, buoyed by positive sentiment from JPMorgan, specifically analyst Steven Alexopoulous. Mostly because they were already down so far that there wasn’t much lower they actually could go, and with deposit outflows in visible decline, there was a sense that the worst was over.

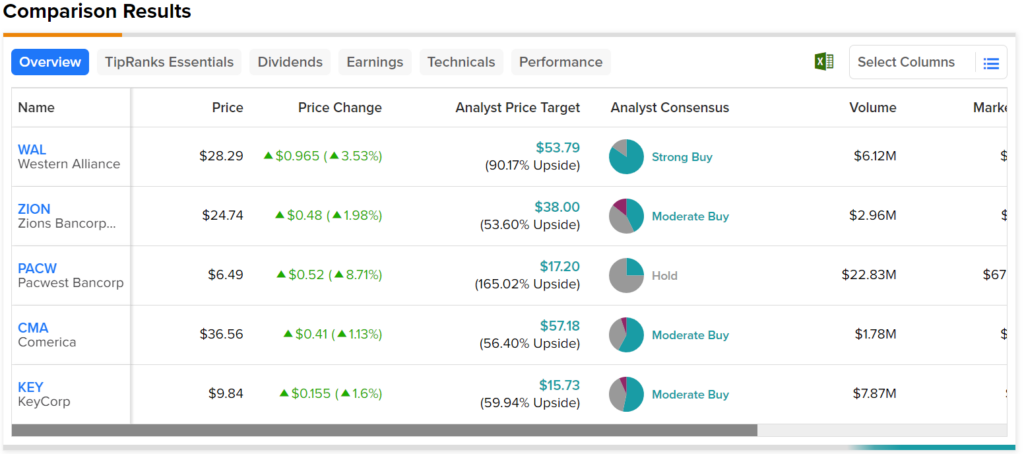

KeyCorp (NYSE:KEY), Zions Bancorporation (NASDAQ:ZION), and Comerica (NYSE:CMA) gained under 2%, while Pacwest Bancorp (NASDAQ:PACW) and Western Alliance (NYSE:WAL) gained over 8% and 3%, respectively. In addition, the recent drama has drawn interest from some contrarians: Chuck Griege of Blue Lion Capital points out that there’s been a lot of selling going on and, thus, an opportunity to get in at comparatively attractive prices.

Overall, Western Alliance is the most favored by Wall Street with a Strong Buy consensus rating. It also boasts 90.17% upside potential thanks to its average share price target of $53.79. Conversely, Pacwest is the least favored by analysts with a Hold rating. However, it boasts the best upside potential at 165.02%, thanks to its average share price of $17.20.