Is that a light at the end of the tunnel for regional bank stocks? They’ve been on the ropes for weeks since the events of Silicon Valley Bank. But several stocks were up in Friday afternoon’s trading, thanks in large part to a sea change at JPMorgan.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

JPMorgan analyst Steven Alexopoulos hiked his rating on small-cap and mid-cap banks in the United States to “neutral” following an important point emerging. That point: regional earnings for the first quarter were not the disaster many expected. Deposit flows did not clearly flood out from banks and into fruit jars or mattresses or the like. Alexopoulos noted, “With sentiment this negative, it won’t take much to see a significant intermediate-term favorable re-rating of regional bank stocks.”

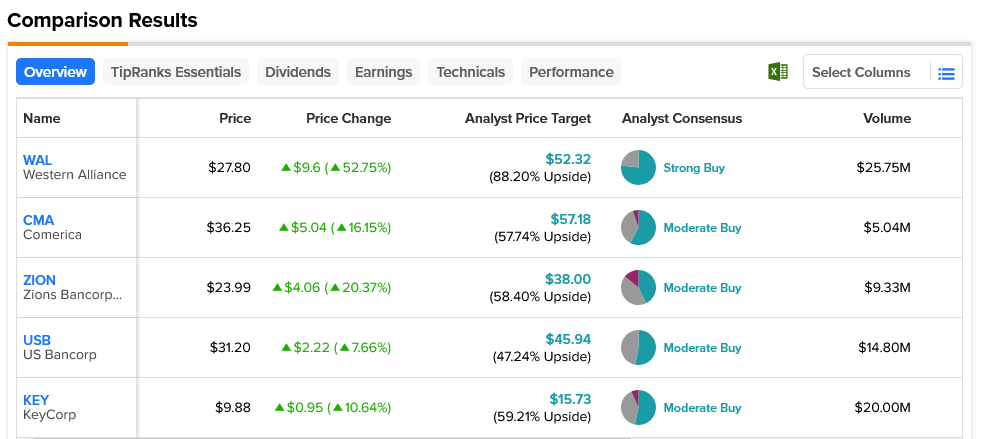

And indeed, improvement showed up all across the spectrum. Western Alliance Bancorp (NYSE:WAL) shot up over 52% in Friday afternoon’s trading. Zions Bancorporation (NASDAQ:ZION) gained over 20%. Comerica (NYSE:CMA) climbed 16%, and even Keycorp (NYSE:KEY) added over 10%. Meanwhile, US Bancorp (NYSE:USB) had the worst day, adding a mere 7.6%. Many of these saw substantial plunges, so the recovery really only gets them back around levels they were at before the crisis began. Still, it’s a clear sign that faith is returning to the regional banking field.

Western Alliance Bancorp stock was the clear winner today, both in gains and overall rating. It’s considered a Strong Buy, and with an average price target of $52.32, it offers investors 88.2% upside potential. US Bancorp, meanwhile, is the weakest in gains and overall picture. It’s a Moderate Buy and offers 47.24% upside potential with an average price target of $45.94 per share.