Shares in Okta (OKTA) dropped 4% in Thursday’s after-hours trading, despite the company reporting solid earnings for the fiscal second quarter.

Specifically, Q2 Non-GAAP EPS of $0.07 beat Street estimates by $0.09. However, GAAP EPS of -$0.48 fell short of consensus forecasts by $0.07.

Revenue came in strong at $200.45M, easily beating Street expectations by $14.08M and increasing 42.7% year-over-year.

Meanwhile, adjusted gross margin of 79% came in a tad higher than the consensus of 77.8%, with billings rising 27% year-over-year to $198.1M (vs consensus of $188.5M).

The cloud-based identity specialist also delivered record free cash flow of $37M. Remaining Performance Obligations (RPO) was $1.43B, up 56% year-over-year, with current RPO at $684.5M (up 48%).

“The three mega-trends that have been driving our business for the past several years – the adoption of cloud and hybrid IT, digital transformation, and zero trust security – are all being accelerated globally by the current environment,” commented Todd McKinnon, CEO of Okta.

He continued: “Organizations are re-evaluating their roadmap to modernize their identity systems and Okta’s platform is the linchpin of the new cloud technology stack.”

As a result, Okta raised its FY21 revenue guidance to $800-$803M from the prior guide of $770-780M on the solid Q2 beat.

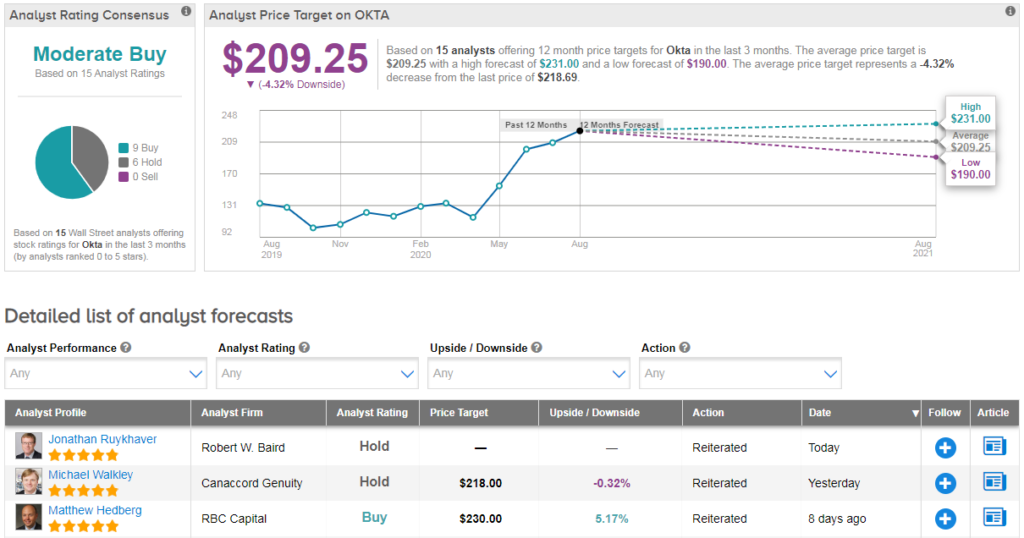

Following the earnings report, Canaccord Genuity analyst Michael Walkley reiterated his hold rating on the stock, but bumped up his price target from $190 to $218.

He noted that Okta’s Q2 results were strong, with any pandemic-related headwinds more than offset by the accelerated tactical needs of those solving for distributed work requirements.

“While Okta is exceptionally well run, uniquely positioned for long-term success, and has a strong balance sheet with $2.3B in gross cash, we prefer to add to positions on any pullbacks” the analyst explained.

With Okta shares up over 100% from the March 20 close, Walkley believes the shares could shed some gains as a potential source of funds with investors rotating to under-performing sectors that are starting to reopen. (See OKTA stock analysis on TipRanks).

Overall, Okta shows a cautiously optimistic Moderate Buy Street consensus with 9 recent buy ratings vs 6 hold ratings. Due to the recent rally, the average analyst price target of $209 indicates shares could pull back 4% from current levels.

Related News:

VMware Tops 2Q Estimates On Stellar SaaS Product Sales

BMO Lowers Palo Alto’s PT After 4Q Beats Estimates

NetApp Leaps 11% In After-Hours On Strong 1Q Results