BMO Capital lowered the price target on Palo Alto Networks to $297 (13.8% upside potential) from $300, despite upbeat 4Q results.

BMO Capital analyst Keith Bachman maintained a Hold rating on Palo Alto (PANW) stock and believes that despite the company’s “very strong” 4Q results with upside to revenue and billings, the stock likely had a muted response in the aftermarket because of high expectations for the quarter and disappointment in the guidance around operating and free cash flow margins. He added that Palo Alto may now be entering a phase of “guiding conservatively and allowing room for upside.”

Meanwhile, Goldman Sachs analyst Brian Essex maintained a Buy rating on Palo Alto and raised the PT to $285 (9.2% upside potential) from $250. Essex is encouraged by the company’s investments into next generation security products. The analyst believes that Palo Alto is well-positioned for enterprise transition to cloud, adding that accelerated cloud adoption led to higher than investors’ expectations on revenues, profits, billings, and cash flows in the quarter.

On Aug. 24, Palo Alto reported revenues of $950.4 million, exceeding Street estimates of $924 million amid the shift to remote working. The network security solution provider reported earnings of $1.48 per share, compared to analysts’ expectations of $1.39 per share. Its billings also surged 32% year-over-year to $1.4 billion and surpassed analysts’ expectations of $1.2 billion. (See PANW stock analysis on TipRanks).

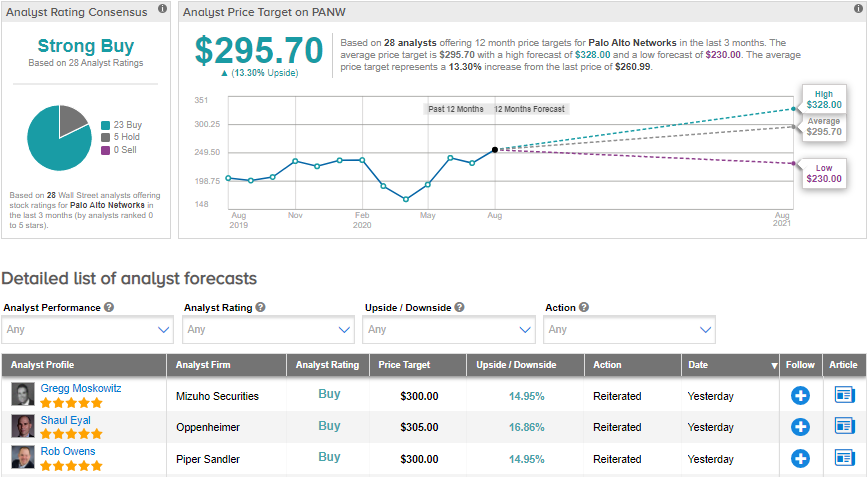

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 23 Buys and 5 Holds. The average price target of $295.70 implies upside potential of about 13.3%. Shares are up around 13% year-to-date.

Related News:

Palo Alto Beats 4Q Estimates Spurred By Remote Working Trend

J.M. Smucker Gains 7% Amid Raised Profit Guidance

Toll Brothers Beats Quarterly Sales Amid Housing Boom