Graphic processer chip maker Nvidia Corporation (NVDA) and Japan-based SoftBank Group Ltd. have decided to terminate the previously announced buyout agreement of SBG’s Arm Limited by Nvidia. The decision is followed by “significant regulatory challenges” faced by the companies despite their best efforts to put the deal through.

Shares of Nvidia are trading down 1.3% in the pre-market trading session today, after closing the day up 1.7% at $247.28 yesterday. NVDA stock has lost 17.9% year-to-date vis-à-vis gaining more than 81% over the past year.

Nvidia Terminates Acquisition of Arm

In September 2020, Nvidia and SBG signed a deal under which Nvidia would acquire the British chipmaker Arm for approximately $40 billion. The deal would have made Nvidia one of the largest chip manufacturers with applications across a spectrum of segments.

However, ever since the deal was announced, it faced regulatory hurdles from authorities across the UK, EU, and the U.S. Federal Trade Commission which sued to block the deal citing the monopolistic nature of the combined entity.

After putting up a tough fight and persistently defending the deal in public, Nvidia withdrew its acquisition plans. As per the terms of the deal, SoftBank will retain the $1.25 billion prepaid by Nvidia for terminating the agreement and in return, Nvidia will continue with its 20-year Arm license.

Arm’s Future Roadmap

After calling off the deal, SoftBank has decided to take Arm Limited public within the fiscal year ending March 2023. In connection with the same, effective immediately, Arm CEO Simon Segars has decided to step down from his position stating that at this stage of his career, he does not wish to put in the time and effort required of taking a company public.

The CEO position will be taken up by Arm’s head of IP Rene Haas, who joined Arm in 2013 and has prior experience of working with Nvidia.

Official Comments

Founder and CEO of Nvidia, Jensen Huang, said, “Arm is at the center of the important dynamics in computing. Though we won’t be one company, we will partner closely with Arm. The significant investments that Masa has made have positioned Arm to expand the reach of the Arm CPU beyond client computing to supercomputing, cloud, AI, and robotics. I expect Arm to be the most important CPU architecture of the next decade.”

Meanwhile, Masayoshi Son, Representative Director, Corporate Officer, Chairman & CEO of SBG, said, “Arm is becoming a center of innovation not only in the mobile phone revolution, but also in cloud computing, automotive, the Internet of Things and the metaverse, and has entered its second growth phase… We will take this opportunity and start preparing to take Arm public, and to make even further progress.”

Consensus View

The NVDA stock commands a Strong Buy consensus rating based on 23 Buys and 3 Holds. The average Nvidia price target of $353.26 implies 42.9% upside potential to current levels. Nvidia’s Q4 earnings are scheduled for February 16.

Blogger Opinions

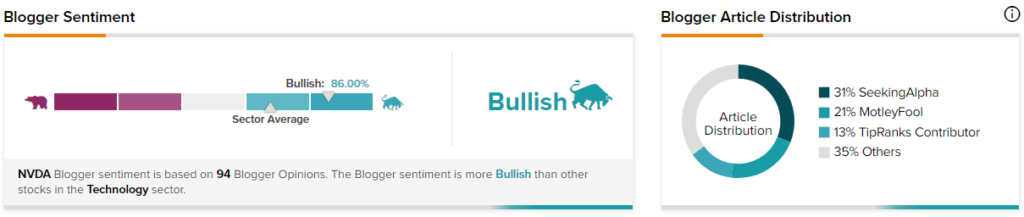

TipRanks data shows that financial blogger opinions are 86% Bullish on NVDA, compared to a sector average of 68%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Kohl’s Initiates Poison Pill to Stop Hostile Takeover; Shares Jump

Chip Shortage Forces Ford to Suspend Production at 8 Plants – Report

Bank of America Hikes CEO Pay by 31% to $32 Million