The Ford Motor Company (NYSE: F) is reportedly shutting or reducing production at eight factories in the U.S. following a COVID-19-triggered global chip shortage, cited CNBC.

Shares of the automaker dropped 9.7%, closing at $17.96 on February 4, after the company reported earnings miss and revenue beat in its fourth-quarter results.

Ford shares have lost 17.1% year-to-date vis-à-vis recording a gain of 101.6% over the past year.

Shutdown and Downtime at 8 Plants

According to the report, Ford has confirmed a production cut at eight of its factories this week for several of its ambitious vehicles, including Ford Bronco and Explorer SUVs, the Ford F-150 and Ranger pickups, the Ford Mustang Mach-E electric crossover, and the Lincoln Aviator SUV.

Factories in Michigan, Illinois, Missouri, and Mexico will face downtime due to the ongoing semiconductor shortage, the company said.

A Reuters report mentioned that Ford will halt production at its Michigan, Chicago, and Cuautitlan, Mexico plants beginning Monday. Moreover, plants in Dearborn, Michigan, and Louisville will face a single shift or downtime. Additionally, Ford is also halting production of the F-150 at the Kansas City plant, while only a single shift will function for its Transit vans.

Automakers are struggling to manage production due to the chip shortages and supply chain issues, an issue pointed out by Ford CEO Jim Farley for Ford’s poor quarterly performance. Although Ford has announced plans to boost its investment in electric vehicles to $20 billion, the persistent chip shortage continues to overshadow the company’s plans.

Official Comments

In an email statement to CNBC, the company said, “The global semiconductor shortage continues to affect Ford’s North American plants – along with automakers and other industries around the world… Behind the scenes, we have teams working on how to maximize production, with a continued commitment to building every high-demand vehicle for our customers with the quality they expect.”

Analysts’ View

Following Ford’s quarterly performance, Wells Fargo analyst Colin Langan lowered the price target on the stock to $24 (33.6% upside potential) from $25 but maintained a Buy rating.

Langan’s optimistic view on the stock stems from the fact that the separation of Ford’s Battery Electric Vehicle (BEV) and internal combustion engine (ICE) businesses is still on the cards. He believes a spin-off of the BEV business would prove to be a potential catalyst that will compel investors to value the “money-losing but growing” BEV and future mobility businesses.

Overall, the Ford stock has a Moderate Buy consensus rating based on 8 Buys, 7 Holds, and 2 Sells. The average Ford price target of $23.56 implies 31.2% upside potential to current levels.

Insider Trading

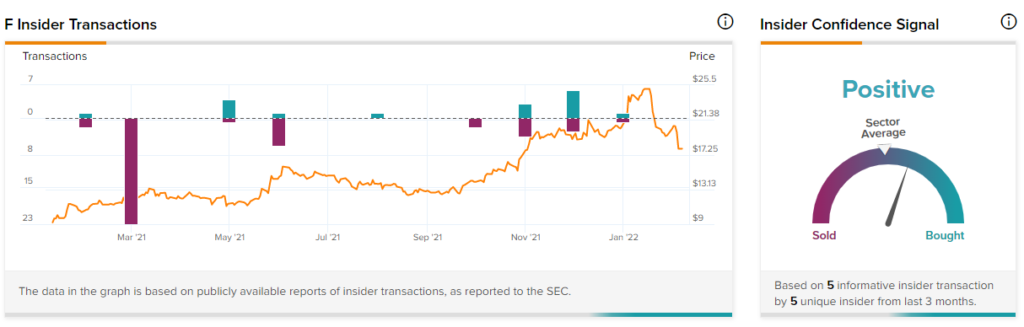

According to TipRanks’ Insider Trading Activity tool, the Insider Signal is currently Positive on Ford, with corporate insiders buying $29.2 million shares of the F stock in the last quarter.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Snap Delivers Stellar Q4 Results; Shares Skyrocket 59% After Hours

Biogen Delivers Mixed Q4 Results; Shares Hit All-Time Low

Eli Lilly Drops 2.4% Despite Beating Q4 Expectations