The rise of the generative artificial intelligence (AI) trend isn’t fading away. If anything, the rise of AI may have many quarters (or perhaps even years) to go following the release of the latest quarterly earnings results from AI chip titan Nvidia (NASDAQ:NVDA), which blew away some pretty sky-high estimates.

Undoubtedly, the Nvidia numbers weren’t just great; they were beyond incredible, helping NVDA stock surge more than 16% earlier today as some of the more skeptical investors out there come to terms with just how profound this AI boom is.

Indeed, it can be tough to play the AI chip game, with share prices (in names like Nvidia) doubling up many times over in a short time frame. And though big booms tend to precede huge busts, it’s unclear as to when the next bust will be and just how long the boom has to go.

After Nvidia’s latest earnings, it seems apparent that the AI trade still has legs. Not only does it have legs, but it has strong legs, perhaps strong enough to lift up the broader basket of technology stocks (including ADBE, which we’ll talk about below) despite their somewhat lofty valuations.

Generative AI’s Tipping Point. Has It Arrived?

Has the AI trend as we know it reached some sort of “tipping point,” as Nvidia CEO and founder Jensen Huang pointed out following his firm’s incredible blowout result? Only time will tell, but, in the meantime, it seems like everybody wants a piece of the trade, as previously absurd valuations begin to look somewhat less lofty following the recent slate of growth numbers.

Personally, I think AI is very much experiencing some sort of “tipping point,” and the good news is that it isn’t just Nvidia that stands to benefit as the entire American economy looks to go after what generative AI has to offer.

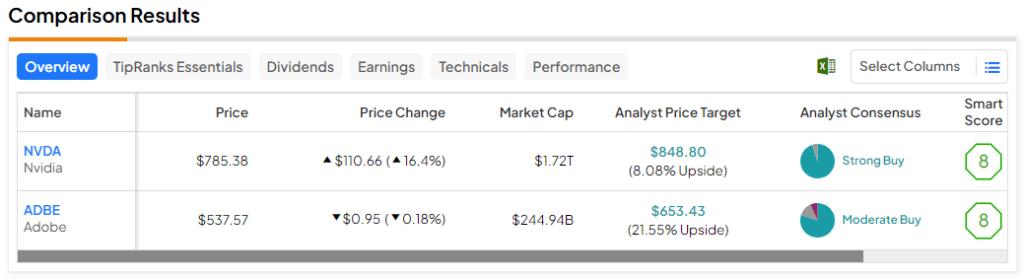

Therefore, let’s check in with AI’s top dogs, Nvidia and Adobe (NASDAQ:ADBE), using TipRanks’ Comparison Tool to see where the analysts stand at this pivotal moment in the AI race. Given AI’s potential, I have to stay bullish on shares of both companies, even if their price-to-earnings multiples tell my inner value investor, “No way!”

Nvidia (NASDAQ:NVDA)

The quarter that made it nearly impossible to impress somehow managed to shock and awe. The company clocked in 265% (you heard that right, folks) in sales growth, bringing fourth-quarter revenues up to $22.1 billion, comfortably ahead of the $20.6 billion estimate. Meanwhile, earnings per share came in up 804%.

That’s growth that’s bordering on absurd. In fact, the quarterly sales growth rate was far more absurd than the stock’s valuation multiple going into the number. Though it’s hard to chase such a hot stock, I think that perhaps Mad Money host Jim Cramer is spot on when he says that Nvidia is a stock to own, not trade.

With a market cap that could find itself flirting with $2 trillion, Nvidia has become the envy of the industry, and it’ll probably continue to be like this as the firm continues swinging home runs on the back of this AI boom.

Although Nvidia remains the hottest stock to play the AI boom, it’s not the only one. As the focus shifts from hardware to software, Adobe stands out as a potential winner for those who may have “missed” Nvidia’s profound ascent.

Is NVDA Stock a Buy, According to Analysts?

NVDA stock is a Strong Buy, according to analysts, with 38 Buys, two Holds, and zero Sells assigned in the past three months. The average NVDA stock price target of $852.48 implies 8.5% upside potential.

Adobe (NASDAQ:ADBE)

Adobe is another firm that’s been investing a great deal in the generative AI boom. Unlike Nvidia, which is more of a pick-and-shovels type of play, Adobe stands to unearth plenty of gold for itself within its corner of creative software. The company’s Sensei product is getting smarter and more impressive as it’s sprinkled across its broad suite of software offerings. Indeed, with generative AI products (including its Firefly platform), everybody can be a designer and let their imaginations run free.

Of all the AI-driven firms, I believe that Adobe is the one that helps unleash human creativity. Augmented with Adobe’s AI-driven innovations, gone are the days when we need to be trained to create incredible images or videos.

With a partnership with Nvidia to work on advanced generative AI models, Adobe stands to gain a great deal from the rise of Nvidia. After Adobe slipped following its earnings report, I view ADBE stock as a great “second chance” type of AI play for those looking to get the perfect mix of value and growth.

For the third quarter, Adobe beat forecasts, with earnings per share number of $4.27 coming in ahead of the consensus estimate of $4.13. Still, the stock eventually moved on to shed around 15% of its value, producing a dip that I view as more than buyable.

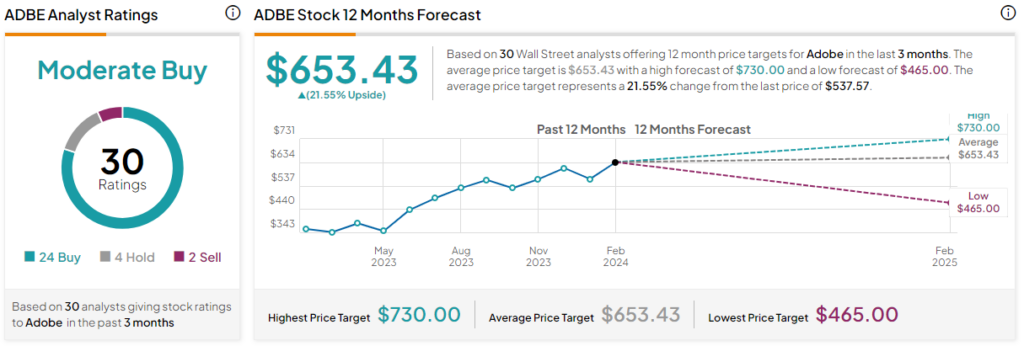

Is ADBE Stock a Buy, According to Analysts?

ADBE stock is a Moderate Buy, according to analysts, with 24 Buys, four Holds, and two Sells assigned in the past three months. The average ADBE stock price target of $653.43 implies 21.6% upside potential.

Better Buy: NVDA or ADBE Stock?

Nvidia isn’t a name I would dare bet against, even as it continues soaring into the sky. That said, between Nvidia and Adobe, I have to go with the latter. It seems like an underappreciated play that has a lot to prove after its recent relatively muted quarterly result.