Biotechnology company Novavax (NASDAQ:NVAX) announced two separate offerings to sell up to $125 million of its common stock and $125 million of convertible senior notes (due 2027). NVAX stock fell over 10% in Wednesday’s extended trading as investors were displeased with the potential dilution of ownership.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Separately, Novavax disclosed in an SEC filing a revised vaccine agreement with the United Kingdom, under which the company will now supply only 7.5 million conditional doses instead of 15 million. The agreement was revised as the U.K.’s Joint Committee on Vaccination and Immunisation didn’t approve the company’s vaccine for certain uses by November 30, 2022. Despite this amendment, Novavax reaffirmed its previously issued 2022 revenue guidance of about $2 billion.

Meanwhile, Novavax expects to use the proceeds from the equity and debt offerings for general corporate purposes, including the continued launch of its COVID-19 vaccine Nuvaxovid and the repayment or repurchase of a portion of the $325 million convertible senior unsecured notes due February 1, 2023.

NVAX stock has plunged nearly 88% year-to-date due to the waning demand for COVID-19 vaccines and persistent manufacturing issues. The company recently announced the termination of its COVID-19 vaccine deal with Gavi. As per Reuters, a Gavi spokesperson stated, “It is clear that Novavax will not be able to meet its commitment to manufacture.”

What is the Prediction for Novavax Stock?

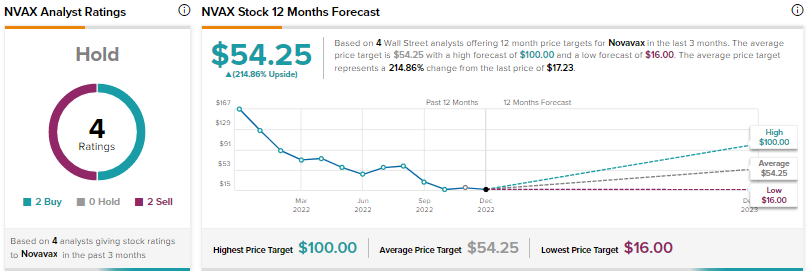

Wall Street’s Hold consensus rating for Novavax stock is based on two Buys and two Sells. The average NVAX stock price target of $54.25 implies nearly 215% upside potential. Following the significant decline in the stock price, Novavax is trading at a forward Price/Sales (P/S) multiple of 0.67, which is 96% lower than its five-year average.