Novavax (NASDAQ:NVAX) stock plunged over 10% on Tuesday after the company announced the termination of the COVID-19 vaccine deal with Gavi. Gavi is an international organization that aims to improve access to vaccines in low-income countries.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As per the agreement, the biotechnology company was required to deliver 350 million doses of its vaccine. Novavax stated that Gavi has breached the contract as it has received orders for only 2 million doses so far.

Novavax’s performance this year has been affected by lower demand for its COVID-19 vaccines in general. Novavax slashed its full-year revenue outlook for the second time in 2022 during the third-quarter 2022 results release. The company now expects revenue of $2 billion, which is at the low end of its prior guidance range of $2 billion to $2.3 billion.

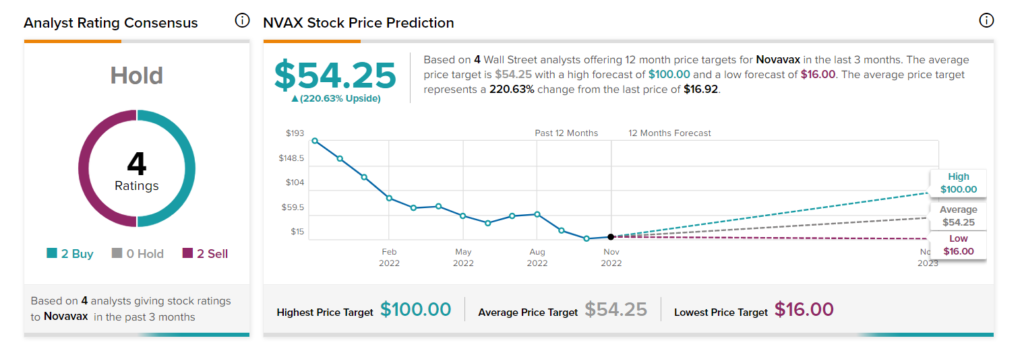

Is Novavax a Buy, Hold or Sell?

Given the company’s ongoing vaccine-related challenges, Novavax stock has received two Buy and two Sell recommendations, for an overall Hold consensus rating. The NVAX stock average price forecast of $54.25 implies 220.63% upside potential.

TipRanks’ data shows that hedge funds have a negative signal on the stock. Over the past quarter, hedge funds sold 1.2 million shares of NVAX. Further, Novavax holds a 1 out of 10 on TipRanks’ Smart Score ranking, which suggests that it is likely to underperform market expectations.