The gold price could zoom close to an unprecedented $5,000 an ounce by the end of next year according to the latest forecast from investment bank Goldman Sachs (GS).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Western Wind

The bank lifted its end of 2026 forecast to $4,900 an ounce from previous expectations of $4,300 an ounce. Goldman said the demand for gold was “sticky”, driven by central bank buying, including the People’s Bank of China, and Western investors putting their cash into gold-linked ETFs.

“Emerging Markets central banks are likely to continue the structural diversification of their reserves into gold,” said analyst Lina Thomas. “We also expect Western ETF holdings to rise on Federal Reserve cuts and private sector diversification into the market.”

The gold price was down slightly in early trading today but is still tanatalizingly close to the $4,000 an ounce mark – see below:

It has surged over 51% in the year to date ticking off new records on the way. It has been driven by the factors identified by Goldman Sachs, but also investor concerns over a weak dollar, and the need for a safe haven during current economic and geopolitical strife.

The U.S. government shutdown, the collapse of another French government and expectations of further interest rate cuts have also made gold look even shinier.

Crypto Link

Kathleen Brooks, research director at XTB, said the rally in gold is part of the so-called ‘debasement’ trade. This is driving demand for alternative assets such as gold and crypto, as the dollar faces a long-term decline and fiscal concerns continue to rise around the world.

At the same time as gold is closing in on the $4000 per ounce level, bitcoin rose to a fresh record on Monday.

“The debasement trade is fusing together the world’s biggest safe haven with one of the riskiest assets out there, bitcoin. We do not see this coming to an end any time soon,” Brooks said. “In the last few weeks, the correlation between bitcoin and gold has gone from a mere 6% to 36%, which means that Bitcoin and gold now move together a third of the time. This is how much the world has changed and it could be a sign that digital assets are becoming a more trusted source of value in the current environment.”

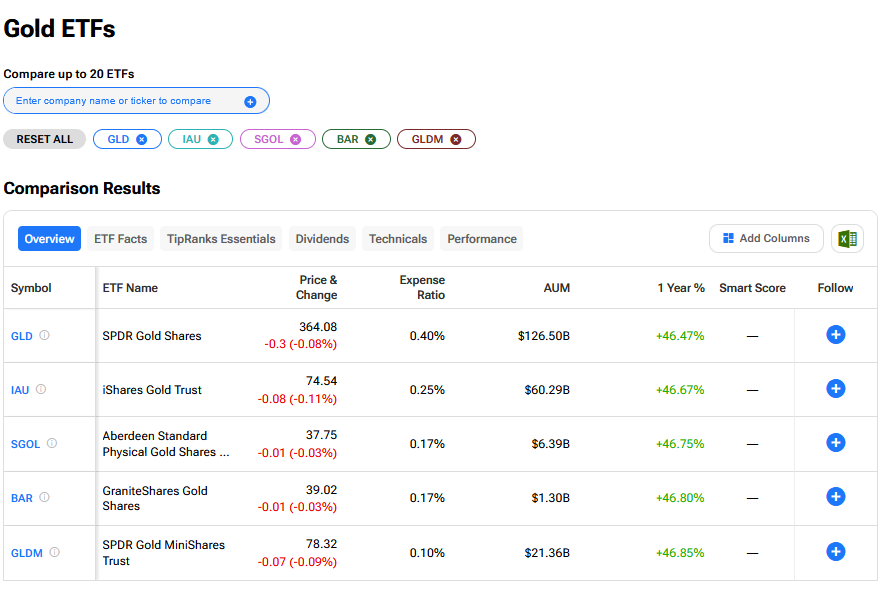

What are the Best Gold ETFs to Buy Now?

We have rounded up the best gold ETFs to buy now using our TipRanks comparison tool.