Gold prices have surged to another record high as investors fretted about a potential U.S. government shutdown.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

President Donald Trump is planning a bipartisan gathering of the top four US congressional leaders at the White House later today. The shutdown will happen unless Congress can reach a funding agreement before the start of the new fiscal year on 1 October.

Services Stopped

Without that cash, many parts of the government can’t operate and federal agencies would have to stop all non-essential functions until a solution is found.

A shutdown would threaten the release of key data including this Friday’s payrolls report, which economists expect to show subdued jobs growth in September.

Gold futures contracts were more than 1% higher by mid-morning, trading around the $3,745.60 per troy ounce mark. Spot gold prices rose 1.6% to $3,818.

“Ultimately, the budget impasse holds a mirror up to longer-term concerns about fiscal deficits and unsustainable spending,” said Neil Wilson, UK investor strategist at Saxo Markets.

The shutdown fears weakened the dollar which tends, along with political and economic uncertainty, to make gold more attractive to investors.

“Although stock markets have absorbed this shutdown risk well, and futures point to a higher open for US indices later today, concern about a government shut down is being expressed via the gold price,” said Kathleen Brooks, research director at XTB.

Rate Cuts

It could also lead to more interest rate cuts – another key driver for the gold price as it tends to look more attractive when rates are lower.

“Right now, there are just over two rate cuts priced in for 2026 by the Fed Funds Futures market, this could be recalibrated higher later this week if the US government does shutdown,” Brooks said.

Other key drivers behind the gold price surge both today and this year – see above – are central banks buying up the precious metal given economic volatility and geopolitical worries in Ukraine, the Middle East and Taiwan.

Leading bank Goldman Sachs (GS) has forecast that these drivers could see the gold price zoom past $4,500 an ounce next year and even hit $5,000 if investors keep piling into the precious metal.

It forecast that gold could hit $3,700 by the end of 2025 and $4,000 by mid-2026.

Deutsche Bank (DB) has forecast that the gold price will race to $4,000 in 2026 buoyed by strong demand from central banks given global uncertainty and interest rate cuts.

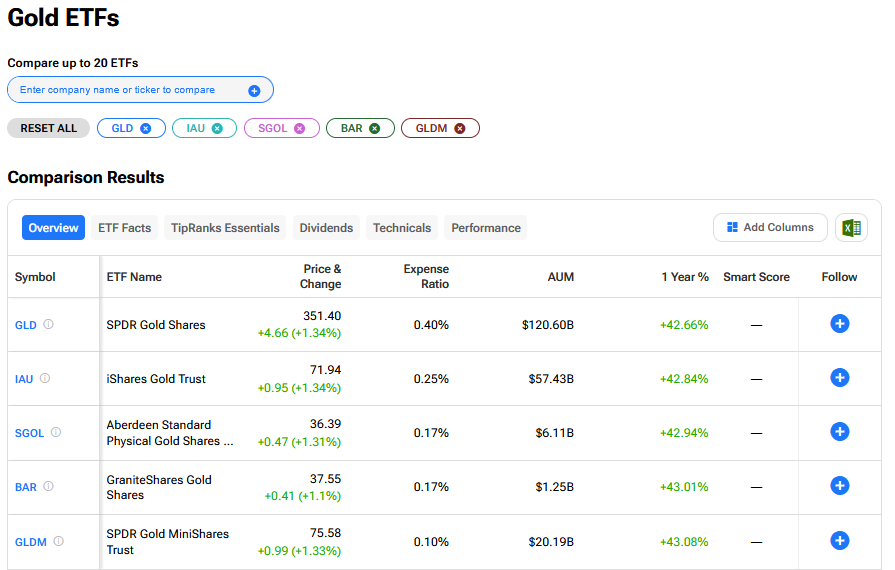

What are the Best Gold ETFs to Buy Now?

We have rounded up the best gold ETFs to buy now using our TipRanks comparison tool.