Adding an advertising-supported tier of service was, arguably, one of the best things Netflix (NASDAQ:NFLX) ever did, at least as far as investors are concerned. This does come with a few potential hiccups, particularly those that relate to the ad market as a whole. But the streaming video giant is up nearly 2.5% in the closing minutes of Wednesday’s trading, and it’s thanks to the ad market, which is looking to make a comeback.

The new reports from media-data operation GumGum revealed that the market for connected TV advertising was likely to surge. And surge big, too; by 2028, that market should be worth a whopping $44 billion. Meanwhile, Netflix’s share of that is likely to improve, as its costs to advertisers have been steady and will likely stay so through this year. That might set up Netflix as a bargain provider, and between that and its sheer reach may make it more attractive to advertisers who will be looking to buy in the not-too-distant future.

A Troubling Dichotomy

Yet, even as this picture looks bright, here’s where a strange new dichotomy kicks in. Just seven days ago, we heard about how Wedbush threw Netflix out of its Best Ideas list. Why? Because most of Netflix’s “growth drivers” were already priced in. Thus, its capacity for growth was somewhat limited. Keep that in mind when I tell you the next point: yesterday, Wedbush hosted an industry expert call where it noted that advertising video on demand was likely to accelerate beyond 2024’s first quarter. That includes Netflix. How exactly those two points live together is, at best, unclear.

What Is a Good Price for Netflix Stock?

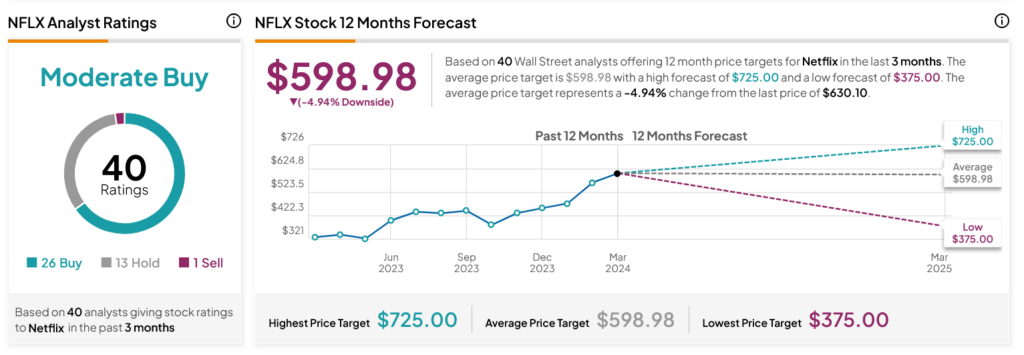

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 26 Buys, 13 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After an 81.24% rally in its share price over the past year, the average NFLX price target of $598.98 per share implies 4.94% downside risk