Shares of streaming and entertainment giants Netflix (NASDAQ:NFLX) and Disney (NYSE:DIS) had a solid start to 2024. For instance, NFLX stock is up about 29% year-to-date. Meanwhile, DIS increased over 32%, outperforming the S&P 500’s (SPX) nearly 10% gain.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Netflix’s introduction of an ad-supported tier, strong content lineup, efforts to tackle password sharing, and expansion of its paid membership base instilled confidence among investors. As for Disney, the company’s initiatives aimed at cost reduction, operational efficiency, and enhancing its direct-to-consumer business propelled its stock price higher.

Against this backdrop, let’s look at what the Street recommends for NFLX and DIS stocks.

What is the Prediction for Netflix Stock?

Netflix stock has gained about 91.5% in one year. While the stock has gained quite a lot, Citi analyst Jason Bazinet increased NFLX’s price target to $660 from $555 on March 25. The analyst noted that Netflix’s net subscriber additions surpassed expectations for three consecutive quarters. Further, the analyst expects the momentum to sustain in the foreseeable future. Bazinate has a Hold rating on Netflix stock.

On March 24, KeyBanc analyst Justin Patterson maintained a Buy on NFLX stock and increased the price target to $705 from $580. The analyst sees Netflix’s content quality is improving, and that should drive engagement and monetization.

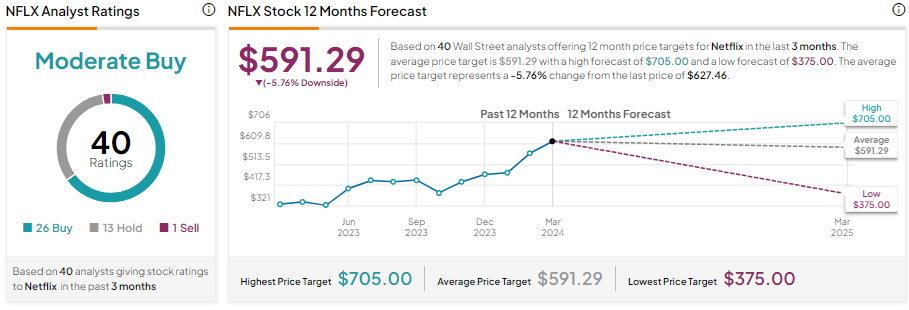

Overall, Wall Street is cautiously optimistic about Netflix stock, given the recent rally in its shares. The stock has 26 Buys, 13 Hold, and one Sell recommendation for a Moderate Buy consensus rating. Analysts’ average price target on NFLX stock is $591.29, implying a 5.76% downside potential from current levels.

Is Disney a Buy, Sell, or Hold Stock?

While Disney stock has delivered notable gains year-to-date, it is engaged in a proxy contest with activist investor Nelson Peltz regarding the restructuring of its board. Meanwhile, Barclays upgraded Disney to Buy from Hold on March 25. Disney’s ongoing efforts to revamp its operations are expected to bolster its financial performance and enhance its overall valuation.

DIS stock has a Moderate Buy consensus rating based on 18 Buys, four Holds, and one Sell. The analysts’ average price target on DIS stock of $120.46 implies a 0.92% upside potential.