Streaming giant Netflix (NASDAQ:NFLX) is in early discussions to live-stream a celebrity golf tournament that will feature professional golfers and Formula One drivers, the Wall Street Journal reported. If talks finalize, then this event would mark Netflix’s entry into live sports streaming.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Netflix’s Potential Entry into Live Sports Streaming

The event, scheduled for this fall in Las Vegas, would feature celebrities from Netflix’s hit documentary Drive to Survive about Formula One auto-racing and the Full Swing docu-series that covered some of the world’s best golfers.

The streaming space has become highly competitive. Streaming giants are taking various initiatives to attract additional subscribers. Rival streaming services Apple’s (NASDAQ:AAPL) Apple TV+ and Amazon (NASDAQ:AMZN) Prime Video have already entered the live sports streaming space by acquiring the rights to major league soccer and National Football League’s Thursday night games, respectively.

In November 2022, the Wall Street Journal reported that Netflix bid for the ATP tennis tour’s streaming rights for some European countries, including France and the U.K., but pulled back later. The media outlet also said that the company bid or considered bidding for the rights to stream tennis and cycling events. Additionally, Netflix reportedly bid for the U.S. streaming rights to Formula One last year, but ESPN won the deal.

Netflix is in the early days of testing live streaming, with a comedy special with Chris Rock in March marking its first live event. Unfortunately, in April, Netflix disappointed viewers as it delayed streaming the reunion special episode of the reality TV show Love is Blind. Overall, the company is trying to boost its business through various initiatives like live streaming and the launch of ad-supported plans.

Is Netflix a Buy or Hold?

On Monday, CFRA analyst Kenneth Leon boosted the price target for Netflix stock to $475 from $390 and reiterated a Buy rating. Leon believes that NFLX will retain its lead as “the best and most prolific provider” of entertaining content around the world on a superior technology platform.

The analyst expects the company’s key drivers to boost revenue growth in the second half of 2023 and in 2024. Further, he noted that Netflix is not seeing cannibalization of its higher-priced ad-free subscriber base following the launch of its new ad-pay plans. Leon also expects the top line to benefit from the company’s password-sharing crackdown.

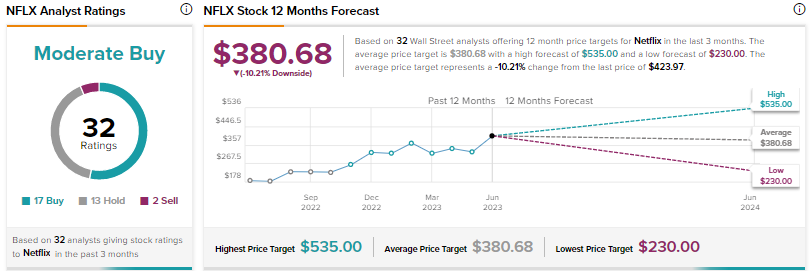

With 17 Buys, 13 Holds, and two Sells, Netflix earns a Moderate Buy consensus rating. The average price target of $380.68 implies a possible downside of 10.2% from current levels. Shares have risen nearly 44% year-to-date.