It’s a bright Friday for Netflix (NASDAQ:NFLX), as the streaming giant experienced a surge in its shares at the time of writing. This upward trend is being attributed to a recent influx of subscribers following Netflix’s crackdown on password sharing in the United States. The company had previously tested measures to limit account sharing across different households in several other countries, and just three weeks ago, these measures were enforced in the U.S. market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This move has seemingly paid dividends, resulting in a significant spike in subscriber numbers, as reported by the research firm, Antenna. In the wake of announcing these changes, Netflix’s average daily sign-ups rocketed to 73,000, a 102% increase from the preceding 60-day average. This uptake even outperformed the sign-up surge seen during the early days of COVID-19 lockdowns.

From the day Netflix began curbing password sharing in the U.S. (May 23, 2023), it enjoyed its four largest single days of U.S. user acquisition in the four and a half years that Antenna has been tracking the company. While the cancellation rate also saw an uptick, it was dwarfed by the increase in sign-ups, with the sign-up to cancellation ratio showing a 25.6% rise when compared to the previous 60 days.

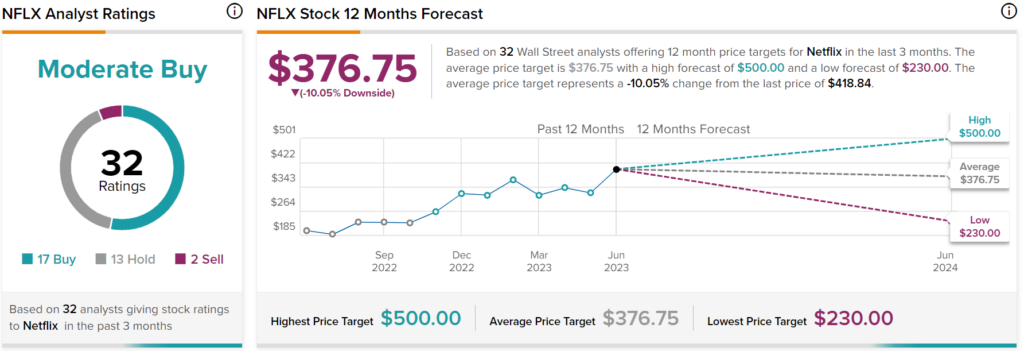

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 17 Buys, 13 Holds, and two Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $376.75 per share implies over 10% downside potential.