Neptune, the largest private flood insurance provider in the U.S., is targeting a valuation of $2.76 billion in its upcoming New York IPO.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Flood Tech

It is understood that some existing shareholders of the Florida flood insurance AI tech provider are targeting to raise up to $368.4 million by offering 18.4 million shares priced between $18 and $20 apiece.

The company announced earlier this month that had filed for an IPO with the U.S. Securities and Exchange Commission (SEC), and will use the ticker symbol NP.

At the time it said that its use of AI technology and its data-driven approach was helping to disrupt the insurance industry.

Neptune launched its platform back in 2018 and has tapped into rising demand from homeowners and businesses looking to mitigate flood risks due to climate change and rising seas. That demand is only expected to increase in the years ahead.

According to its SEC filing, Neptune generated $137 million in revenue over the 12 months that ended June 30, a 37% year-over-year increase. In August, Neptune announced that it exceeded 250,000 policies in force, representing more than $320 million in premiums.

In 2023, private equity firms Bregal Sagemount and FTV Capital had bought a minority stake in Neptune.

Cornerstone investors T. Rowe Price Investment Management and AllianceBernstein have separately indicated interest in purchasing up to $75 million in shares from Neptune’s offering.

IPO Fever

Other insurance firms to go public this year include American Integrity (AII) – see share price performance below – and Slide Insurance (SLDE).

But it’s not only insurance firms hitching on to renewed IPO enthusiasm despite continued economic uncertainty.

Recent IPOs include tech firms Figma (FIG) and Klarna (KLAR).

Several other companies have filed with the U.S. Securities and Exchange Commission (SEC) to go public in coming months, including cryptocurrency exchange Gemini, blockchain lender Figure, and American Bitcoin, the Bitcoin mining firm associated with U.S. President Donald Trump’s sons Eric and Don Jr.

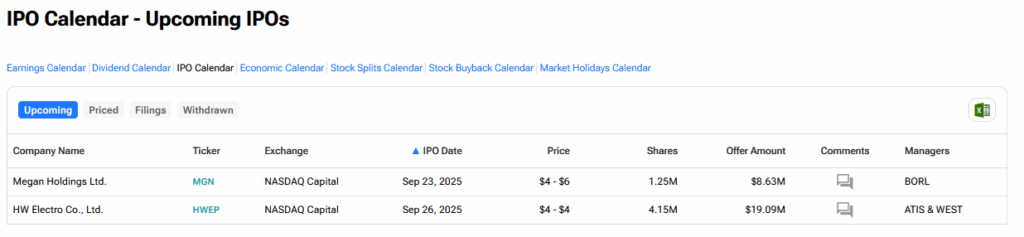

What Other IPOs are on the Way?

Let’s take a look at the TipRanks IPO calendar to see what lies ahead for new issues.