Crypto stocks Strategy (MSTR) and Coinbase Global (COIN) are set to release their quarterly results on October 30. Both have outperformed the market over the years, driven by the steep rise in cryptocurrency prices, especially Bitcoin (BTC-USD).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, each faces unique macro and company-specific challenges that could intensify after earnings. Let’s examine which stock is a better buy as Q3 results approach.

Strategy Stock (MSTR) Forecast

Wall Street expects Strategy to report a diluted loss of $0.10 per share on sales of $116.65 million. These figures compare favorably to the prior year quarter’s figures of a loss of $1.72 per share on sales of $116.07 million. Unfortunately, Strategy has surpassed analysts’ expectations in only two of the past eight quarters.

As such, Strategy’s business is to provide enterprise analytics software and services globally, which provides a steady revenue stream. However, the company has made buying and holding Bitcoin reserves part of its corporate strategy and has to report the unrealized gains and/or losses from its BTC holdings within its operating expenses. Hence, the company witnesses wild swings in its quarterly net income and earnings per share figures.

According to a recent regulatory filing, Strategy sold preferred stock between October 20 and October 26, 2025, to raise $43.4 million and used it to buy 390 Bitcoin. This brings total Bitcoin holdings to approximately 640,808, valued at around $47.44 billion.

Is MSTR Stock a Good Buy Right Now?

Ahead of the results, TD Cowen analyst Lance Vitanza reiterated his Buy rating on MSTR stock with a price target of $620, implying an impressive 117.8% upside potential from current levels. He expects the company to hold nearly 900,000 BTC by 2027, representing over 4% of the total supply.

Vitanza also sees positive long-term tailwinds from Bitcoin’s mainstream acceptance and favorable regulatory developments, like potential easing of restrictions on banks investing in digital currencies.

Coinbase Global Stock (COIN) Forecast

Analysts expect Coinbase to report strong growth in Q3, with diluted earnings per share (EPS) of $1.15 on sales of $1.80 billion. In the comparative period last year, the company reported $0.28 on sales of $1.21 billion. Coinbase has exceeded consensus estimates in five of the past eight quarters.

Coinbase operates one of the world’s largest crypto exchanges and fintech platforms. Its vertically integrated model allows it to act as a broker, market maker, and custodian. The company’s performance remains highly correlated with cryptocurrency price swings but is also supported by transaction fees, stablecoin service charges, and revenue from staking and yield-generating activities on USDC.

Recently, Coinbase announced a strategic partnership with Citigroup (C) to enable Citi’s institutional clients to deposit and withdraw fiat currencies through Coinbase’s platform.

Is COIN Stock a Buy Right Now?

JPMorgan analyst Ken Worthington upgraded COIN from a Hold rating to Buy and raised his price target from $342 to $404, implying 13.7% upside potential. He sees two major growth drivers: the potential launch of a Base token for Coinbase’s Layer 2 blockchain, which could add $12 billion to $34 billion in value, and higher USDC yields for Coinbase One subscribers, which could contribute about $1.00 in additional EPS annually.

MSTR or COIN: Which Crypto Stock Is a Better Buy, According to Analysts?

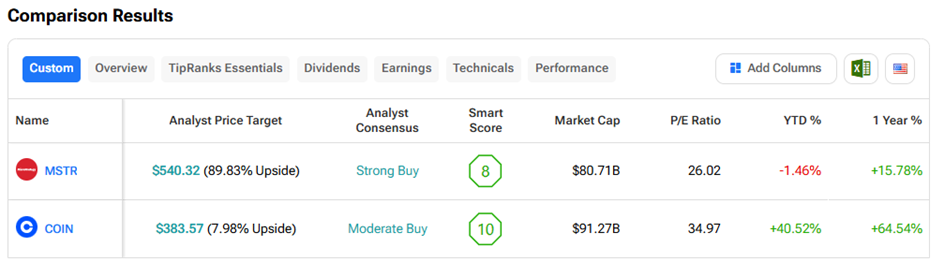

Using TipRanks’ Stock Comparison Tool, we compared MSTR and COIN to see which crypto stock analysts favor. Currently, MSTR carries a “Strong Buy” consensus rating and a higher upside potential of 89.8% over the next twelve months.