Shares of Microsoft (NASDAQ:MSFT) trended lower in pre-market trading on Wednesday as the tech giant’s fiscal Q2 earnings beat did little to tamper investors’ concerns about the company’s muted fiscal Q3 outlook.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Microsoft noted on its earnings call that looking at Q3, currency headwinds could drag down its growth in total revenues by around three percentage points, and by the same percentage points for its Intelligent Cloud business.

Even as the company’s management noted on its Q2 earnings call that PC demand continued to be subdued, analysts were also concerned about MSFT’s cloud business.

MSFT’s cloud business saw revenues jumping 18% year-over-year to $21.5 billion in Q2. However, in the third quarter, the company has projected cloud revenues to be in the range of $21.7 billion to $22 billion, falling short of analysts’ forecasts of $22.14 billion.

The company stated on its earnings call that when it comes to its cloud business, revenues will “continue to be driven by Azure which, as a reminder, can have quarterly variability primarily from our per-user business and from in-period revenue recognition depending on the mix of contracts.”

Analysts have been concerned that tech companies could see a slowdown when it comes to their lucrative cloud business as customers could cut their cloud spending citing macro volatility. MSFT acknowledged on its earnings call that it had observed its customers being cautious in their cloud spending in fiscal Q2.

This uncertainty over Azure prompted BMO Capital analyst Keith Bachman to downgrade the stock to a Hold from a Buy and lowered the price target to $265 from $267. The analyst’s current price target implies an upside potential of 9.5% at current levels. Bachman expects the stock to be “range bound” unless this uncertainty resolves.

The analyst has projected growth of Azure at the end of FY24 to be in the mid-to-high teens versus his current estimate of 20%.

Microsoft’s CEO Satya Nadella also addressed the company’s investment in ChatGPT owner, OpenAI, and its emphasis on AI at its earnings call.

Nadella commented, “Maximum [business] value gets created during shifts in the market. We are well positioned to capture the opportunities in AI used by customers like OpenAI.”

OpenAI is working with MSFT’s cloud service, Azure and the company’s management indicated on its earnings call that revenus from OpenAI’s related businesses would be reflected in MSFT’s Azure cloud business.

In a separate issue, on Wednesday a network outage led to cloud platform Azure along with services such as Teams and Outlook being down for millions of users around the globe. However, later in the day, these services were resumed.

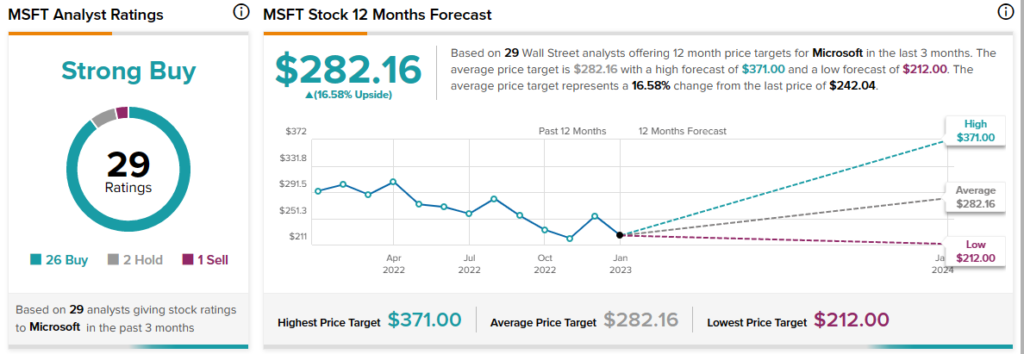

Overall, analysts remain bullish about MSFT stock with a Strong Buy consensus rating based on 26 Buys, two Holds and one Sell.