Shares of Microsoft (NASDAQ:MSFT) rose initially but then declined in after-hours trading after the company reported earnings for its second quarter of Fiscal Year 2023. MSFT stock is down 2.5% in pre-market trading at the last check.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Earnings per share came in at $2.32, which beat analysts’ consensus estimate of $2.29 per share. Sales increased by 2% year-over-year, with revenue hitting $52.7 billion. This missed analysts’ expectations of $52.94 billion.

Investors cheered the earnings beat initially but reacted negatively to the dim outlook provided for Q3FY23. In the earnings call, Microsoft CFO Amy Hood noted that they continue to see subdued demand in the PC market. Additionally, the overall revenue deceleration seen in 2022 will continue to impact the 2023 results.

Revenue for the Azure cloud product division was up 31%. The Intelligent Cloud division—which includes Azure—posted $21.5 billion in revenue, narrowly beating consensus figures calling for $21.4 billion. Its Productivity and Business Processes segment added $17 billion in revenue as well, beating consensus estimates of $16.79 billion. As for the More Personal Computing segment, which includes Xbox, Surface, and search advertising, that added $14.24 billion. That accounted for a drop of 19% against this time last year.

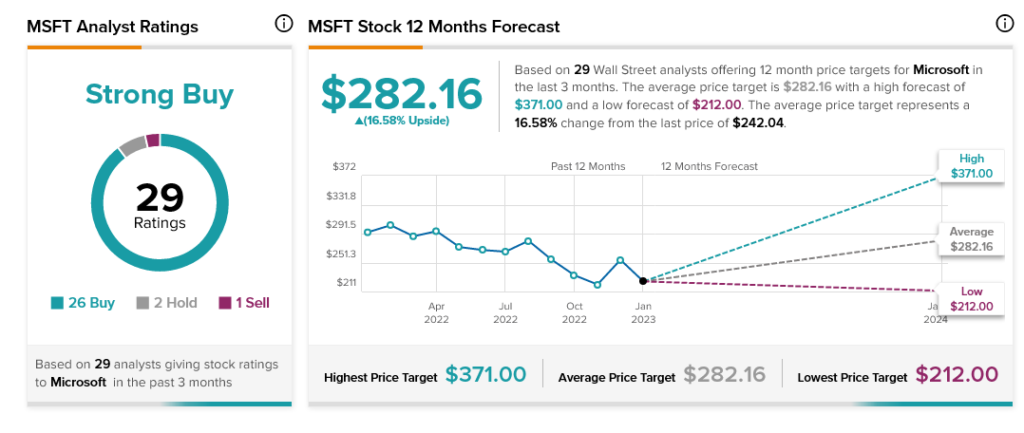

Overall, Wall Street has a consensus price target of $282.16 on Microsoft stock, implying 16.58% upside potential, as indicated by the graphic above.

Join our Webinar to learn how TipRanks promotes Wall Street transparency