Microsoft’s (NASDAQ:MSFT) $69 billion acquisition of Activision Blizzard (ATVI) hits another major roadblock as a U.S. judge temporarily blocks the deal. The move comes after the Federal Trade Commission (FTC) requested a preliminary injunction and a restraining order to halt the deal on Monday.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

U.S. District Judge Jacqueline Scott Corley in San Francisco has scheduled a two-day hearing on June 22-23 to thoroughly evaluate all the evidence related to the case. Following this hearing at the end of June, the court will decide whether or not to halt the merger.

Reasons for Blocking the MSFT-ATVI Deal

The judge deemed it necessary to implement the temporary block due to the extensive, ongoing legal cases filed by the FTC against the deal. Last December, the FTC requested that an administrative judge block the transaction, and an evidential hearing on the matter is set to begin on August 2.

In addition, the FTC expressed concerns that Microsoft might finalize the acquisition before the upcoming trial, creating difficulties if the deal is later deemed illegal based on antitrust grounds. It is important to note that, in the absence of a court ruling, Microsoft had the option to close the deal as early as Friday.

Approval Status in Other Countries

Interestingly, the acquisition deal is also facing a blockage in the United Kingdom by the Competition and Markets Authority (CMA). The regulatory body expressed concerns regarding the deal, specifically highlighting the potential for Microsoft to gain complete control over the entire market for cloud gaming services.

Meanwhile, MSFT and ATVI have managed to secure approvals in some key jurisdictions, including the European Union and China, indicating a positive development for the progress of the deal.

Is MSFT Stock a Good Buy?

The cloud gaming market is expected to grow at a compound annual growth rate of 35.6% over a five-year period ending in 2026, according to S&P Global Market Intelligence. Thus, if MSFT fails to get a clear green signal from all regulators, it would miss out on Activision’s expertise in cloud gaming, which would otherwise have helped strengthen its gaming position in the cloud market and supported revenue growth.

Nevertheless, based on MSFT’s strong position in the tech sector, Wall Street continues to have a Strong Buy consensus rating for the stock. This is based on 30 Buys, four Holds, and one Sell. The average stock price target of $345.45 suggests about 3.3% upside potential from current levels. Shares have gained 40.2% year-to-date.

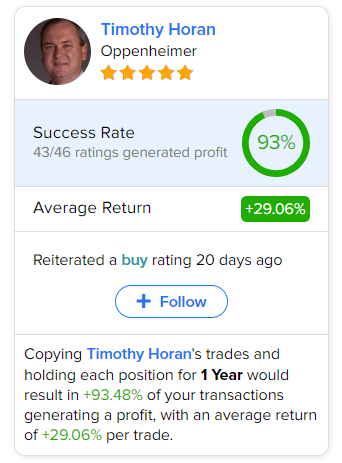

As per TipRanks data, the most accurate analyst for Microsoft is Oppenheimer analyst Timothy Horan. Copying the analyst’s trades on this stock and holding each position for one year could result in 93% of your transactions generating a profit, with an average return of 29.06% per trade. Importantly, the analyst reaffirmed his Buy rating on MSFT stock about 20 days ago.