The U.S. Federal Trade Commission has filed an antitrust lawsuit against Microsoft (NASDAQ:MSFT) in an attempt to block the tech giant’s proposed $69 billion acquisition of leading video game developer Activision Blizzard (NASDAQ:ATVI). The FTC believes that the deal would enable Microsoft to harm competition in multiple and rapidly-growing gaming markets. Last month, a Politico report revealed the possibility of the FTC filing an antitrust lawsuit.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

FTC Opposes Microsoft’s Acquisition of Activision

The FTC pointed out that Microsoft, maker of Xbox gaming consoles, has a track record of acquiring popular gaming content to prevent competition from rival consoles. Citing the example of Microsoft’s acquisition of ZeniMax (parent company of game developer Bethesda Softworks), the FTC noted that Microsoft made several Bethesda’s titles exclusive to its platform despite assuring European regulators that it would not withhold games from rival consoles.

If the acquisition goes through then, Microsoft will have control over Activision’s popular franchises like Call of Duty and World of Warcraft. The FTC believes this would give Microsoft “both the means and motive to harm competition” through various tactics, like manipulating Activision’s pricing or completely withholding content from rivals. The agency’s allegations will now be tried in a formal hearing before an administrative law judge.

Reacting to the FTC’s move, Microsoft President Brad Smith stated, “While we believed in giving peace a chance, we have complete confidence in our case and welcome the opportunity to present our case in court.”

Microsoft announced its proposed acquisition of Activision Blizzard in January this year. ATVI stock rallied in reaction to the news. However, concerns about the deal gaining the approval of regulators across several countries have impacted the stock’s momentum. Overall, ATVI stock has advanced 12.5% year-to-date.

The deal is currently under investigation by antitrust regulators in the U.K. and the European Union. Sony (SNEJF), one of the leading gaming companies, has opposed the deal as it feels that the acquisition would influence players to switch from Sony’s PlayStation to Xbox.

Is Microsoft a Buy, Sell, or Hold?

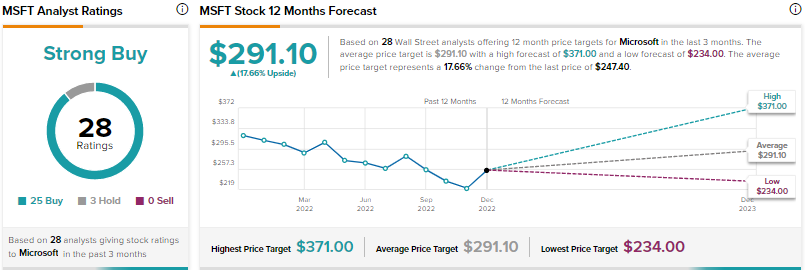

Wall Street’s Strong Buy consensus rating for Microsoft stock is based on 25 Buys and three Holds. The average stock price target of $291.10 suggests about 18% upside potential from current levels. Shares have declined 26.5% year-to-date.