Financial majors Morgan Stanley (NYSE:MS) and HSBC (NYSE:HSBC) (GB:HSBA) are slashing multiple investment banking jobs in the Asia-Pacific, as deal-making cools down in the region.

Slow Deal Flow

The move comes amid weak financial markets in China and Hong Kong and a tepid deal flow. According to Reuters, Morgan Stanley is slashing at least 50 investment banking positions this week. This move is said to impact nearly 13% of its investment banking positions in Asia. Meanwhile, HSBC is slashing nearly 30 positions.

According to LSEG, the value of M&A deals associated with the Chinese market has dropped by around 36%, and the value of funds raised from new listings has shrunk by nearly two-thirds in the region. This slowdown has also prompted downsizing actions from other top Wall Street names such as Bank of America (NYSE:BAC) and Citigroup (NYSE:C) in recent times.

The Bigger Picture

While the current economic environment in China remains challenging, companies such as Morgan Stanley and HSBC are making significant investments in Asia for the long term. According to Bloomberg, Morgan Stanley is gradually establishing its onshore operations in China, recently obtaining approvals for principal trading and research licenses in the country. Similarly, HSBC is in the process of pivoting toward Asia. The company has sold its banking unit in Argentina and certain operations in North America and France. Concurrently, it is expanding its presence in India, Singapore, and China.

Which Bank Stock Is Best to Buy Now?

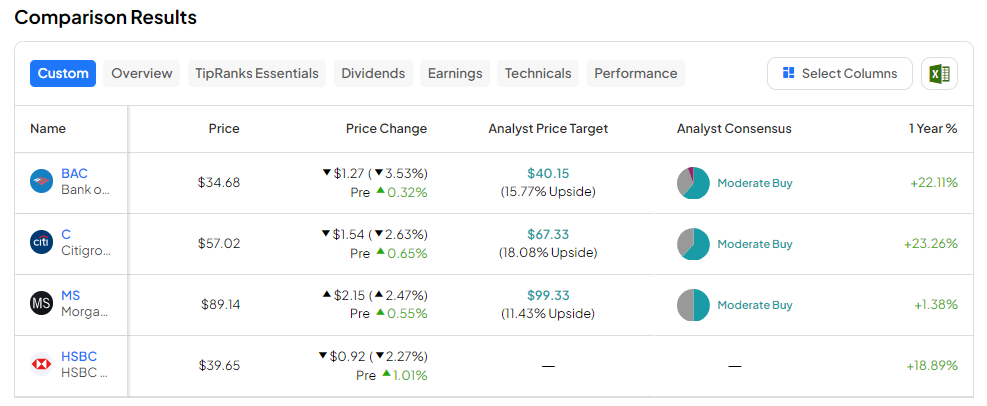

Nearly all of the financial names on our list today have delivered double-digit returns over the past year amid higher interest rates and buoyant equity markets. Meanwhile, the TipRanks Stock Comparison tool indicates the highest potential upside of 18% in Citigroup shares over the coming periods.

Read full Disclosure