The Competition and Markets Authority (CMA), U.K.’s competition regulator, has reopened its review of Microsoft’s (NASDAQ:MSFT) proposed $69 billion acquisition of Activision Blizzard (NASDAQ:ATVI) and is seeking public opinion ahead of a final decision by the authority on August 29.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

U.K. Regulator Reignites Hopes for Deal Approval

The CMA had previously blocked the deal in April, citing concerns that Microsoft’s acquisition of Activision could impact competition in the emerging cloud gaming market. Microsoft submitted new documents to the CMA on July 25, urging the regulator to consider the change in circumstances for approving the deal. The CMA is seeking public comments by August 4 on the new documents submitted by Microsoft.

Calling submissions of this kind possible but “very rare,” a CMA spokesperson said, “We will consider Microsoft’s submissions carefully, along with other responses from interested parties, ahead of the 29 August statutory deadline.”

In particular, Microsoft has asked the CMA to revisit its decision, given the company’s recent agreement with the European Commission and a new 10-year licensing deal with rival Sony (NYSE:SONY) that will allow it to keep Activision’s popular gaming franchise Call of Duty on its PlayStation console. The tech giant also highlighted its agreements with Nvidia (NASDAQ:NVDA), Boosteroid, and Ubitus, which it believes should address the CMA’s concerns about the impact of the deal on competition.

Microsoft added that any breach of its commitments to the European Commission would make the European approval invalid and put the company at risk of fines of up to 10% of its overall turnover, which would amount to $19.8 billion based on its 2022 turnover.

In the new documents, Microsoft also highlighted that U.S. District Judge Jacqueline Scott Corley recently dismissed the U.S. Federal Trade Commission’s (FTC) application for a preliminary injunction blocking the merger.

Last month, Microsoft and Activision extended the deadline for their agreement to October 18 from July 18, due to regulatory troubles from the U.S. and the U.K.

Is Microsoft a Buy, Sell, or Hold?

On Monday, Argus analyst Joseph Bonner increased the price target for Microsoft to $390 from $371 and reiterated a Buy rating in reaction to the Fiscal Q4 earnings beat. Bonner thinks that the company’s proposed Activision acquisition is looking much more viable after Microsoft inked distribution agreements with rivals and won a series of regulatory court battles in the U.S.

The analyst highlighted Microsoft’s diversified assets and believes that the stock may even be a haven for investors looking for a flight to quality in uncertain times.

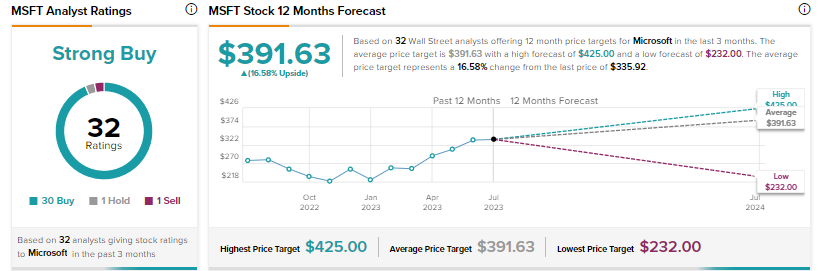

Wall Street’s Strong Buy consensus rating on Microsoft is based on 30 Buys, one Hold, and one Sell. The average price target of $391.63 implies over 16% upside. Shares have advanced 40% year-to-date.

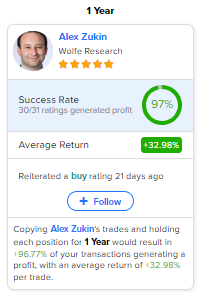

Investors should note that Wolfe Research analyst Alex Zukin is the most accurate analyst for MSFT stock, according to TipRanks. Copying Zukin’s trades on MSFT and holding each position for one year could result in 97% of your transactions generating a profit, with an average return of about 33% per trade.