Tech giants Microsoft (NASDAQ:MSFT) and Sony (NYSE:SONY) have signed a binding agreement to keep the highly popular Call of Duty gaming title on Sony’s PlayStation consoles if Microsoft’s acquisition of Activision Blizzard (NASDAQ:ATVI) goes through. The 10-year deal was announced by Microsoft Gaming CEO Phil Spencer on Twitter, although both companies did not provide additional details on the terms of the agreement.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Microsoft Heading Toward Completion of Activision Deal

The agreement between Microsoft and Sony follows similar deals between Microsoft and several other companies, including Boosteroid, Ubitus, Nvidia (NVDA), and Nintendo (NTDOY).

Sony was a major opponent of Microsoft’s proposed acquisition of Activision since the deal was announced in early 2022. Sony, like several other regulators, expressed concerns about the possibility of Microsoft making popular game franchises of Activision, including Call of Duty, exclusive to its Xbox console, thus hurting competition in the industry.

Some regulators were also worried about Microsoft delaying the release of titles or lowering the quality of games for rival platforms. However, Microsoft has constantly been trying to convince rivals, game developers, and regulators that it has no such intentions. On Sunday, Microsoft’s vice chairman and president Brad Smith tweeted about the Sony agreement, assuring that the company is focused on ensuring that Call of Duty remains available on more platforms.

The agreement with rival Sony comes at a time when Microsoft is moving closer to the July 18 deadline to complete the $69 billion Activision acquisition. On Friday, an appeals court rejected the U.S. Federal Trade Commission’s (FTC) request to halt the acquisition, marking another setback for the agency after a July 11 court ruling allowed Microsoft to go ahead with the deal, saying the FTC didn’t provide substantial evidence that the acquisition would impact competition.

Aside from the FTC, the deal still needs to be approved by the U.K.’s Competition and Markets Authority (CMA). The CMA, which had earlier opposed the deal, said last week that it would extend the period to review the deal by six weeks after receiving a “detailed and complex” new proposal from Microsoft.

Is Microsoft Stock a Buy or Sell?

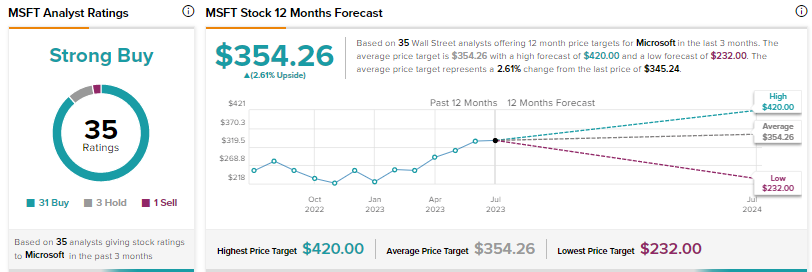

Wall Street has a Strong Buy consensus rating on Microsoft stock based on 31 Buys, three Holds, and one Sell. The average price target of $354.26 implies 3% upside potential. MSFT shares have risen about 44% year-to-date.

On Friday, UBS analyst Karl Keirstead upgraded his rating on MSFT from Hold to Buy and raised the price target to $400 from $345. The analyst cited prospects of Azure cloud-infrastructure spending stabilizing following a slump and artificial intelligence (AI)-related catalysts as the reasons for his upgrade.

Investors looking for MSFT’s most accurate and profitable analyst could follow Wolfe Research analyst Alex Zukin. Copying the analyst’s trades on this stock and holding each position for one year could result in 97% of the investor’s transactions generating a profit, with an average return of 33.1% per trade.