Microsoft’s (NASDAQ:MSFT) proposed $69 billion acquisition of Activision Blizzard (ATVI) has won regulatory approvals in over 35 countries. Nonetheless, the deal is facing opposition from both sides of the pond: the U.S. Federal Trade Commission (FTC) and the U.K.’s Competition and Markets Authority (CMA), on concerns that it could hinder competition, especially in the emerging cloud gaming market. Several regulators and rivals like Sony (SONY) have also expressed concerns about Microsoft denying rival platforms access to popular game franchises, especially the highly successful Call of Duty.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Call of Duty – A Roadblock in the Microsoft-Activision Deal

Launched in 2003, Call of Duty is a first-person shooter game that emerged as one of the most popular gaming franchises with a massive customer base. In mid-2022, Activision revealed that the Call of Duty franchise sold over 425 million units, generating more than $30 billion in revenue over its lifetime. Even in its most-recently announced results for Q1 2023, Activision stated that Call of Duty was “once again a key driver of growth.”

A Wall Street Journal report noted that the U.K.’s CMA cited Call of Duty 41 times in its 20-page summary detailing its decision to block the Microsoft-Activision deal. Further, the U.S. FTC mentioned the gaming franchise 18 times in its 23-page complaint. Meanwhile, the European Union gave its nod to the deal only after Microsoft assured that it would allow rivals to stream Call of Duty and other Activision titles over the cloud.

In its complaint, the FTC said that Call of Duty’s “loyal fanbase and enduring appeal have made it particularly valuable, influencing gamer engagement and gaming product adoption.” It noted Call of Duty’s “sustained dominance” over the past decade, with the franchise titles comprising 10 of the top 15 console games sold between 2010 to 2019. The FTC highlighted that no other franchise had more than one title in the top 15.

Likewise, the CMA also expressed concerns that following the merger, Microsoft would find it “commercially beneficial” to make Call of Duty exclusive to Xbox or available on Xbox on materially better terms than on Sony’s PlayStation. CMA believes that this would “substantially reduce” competition in gaming consoles much to the detriment of gamers.

Meanwhile, Microsoft and Activision have repeatedly assured that the deal won’t impact competition and they would license the franchise to rivals so that gamers can stream existing and future titles through the cloud gaming platform of their preference.

Last week, Microsoft appealed to overturn the U.K. antitrust regulator’s decision to block the $69 billion Activision acquisition. The tech giant seems determined to fight till the end. It has already signed deals with Boosteroid, Ubitus, Nvidia (NVDA), and Nintendo (NTDOY) to allow Xbox PC games to run on their cloud gaming platforms. The 10-year deals give access to Call of Duty and other Activision games if the acquisition wins regulators’ approvals.

Is Microsoft a Good Stock to Buy?

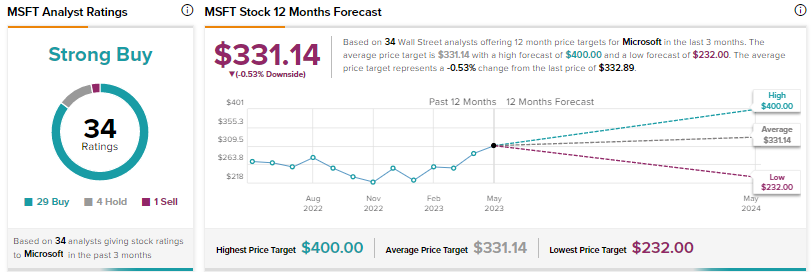

Despite the regulatory overhang related to the Microsoft-Activision deal, Wall Street analysts are bullish on MSFT based on the company’s diversified business model and aggressive push in the artificial intelligence (AI) space.

Wall Street’s Strong Buy consensus rating on MSFT is based on 29 Buys, four Holds, and one Sell. The average price target of $331.14 implies the stock could be range-bound over the near term. Shares have risen 39% since the start of 2023.