The U.S. Federal Trade Commission (FTC) is not yet giving up on its efforts to block Microsoft’s (NASDAQ:MSFT) $69 billion acquisition of Activision Blizzard (NASDAQ:ATVI). The agency said on Wednesday that it would appeal the U.S. District Judge Jacqueline Scott Corley’s decision earlier this week, allowing Microsoft to go ahead with its Activision deal.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

FTC Remains a Roadblock for Microsoft-Activision Deal

FTC had initially filed an antitrust case against Microsoft in December 2022 to challenge the tech giant’s acquisition of Activision, citing anticompetitive concerns. Last month, the FTC filed for a preliminary injunction to block the deal ahead of the July 18 contractual deadline, which was rejected by Judge Corey on Tuesday.

Corey said that the FTC did not prove its assertion that the combined entity will remove Activision’s Call of Duty franchise from Sony (SONY) PlayStation, or the substantial impact of Microsoft’s ownership of Activision titles on lessening competition in the video games and cloud gaming markets.

Reacting to the FTC’s appeal that will go before the Ninth Circuit Court of Appeals on the West Court, Microsoft President Brad Smith emailed a statement to Reuters, saying, “We’re disappointed that the FTC is continuing to pursue what has become a demonstrably weak case, and we will oppose further efforts to delay the ability to move forward.”

Also, an Activision Blizzard spokesperson contended that “The facts haven’t changed,” and expressed confidence that the U.S. will be among the 39 countries where the deal can close.

Meanwhile, U.K.’s Competition and Markets Authority (CMA), which had earlier opposed the merger, said on Wednesday that a restructured deal between Microsoft and Activision could address its concerns, subject to a new investigation.

Is MSFT a Good Stock to Buy?

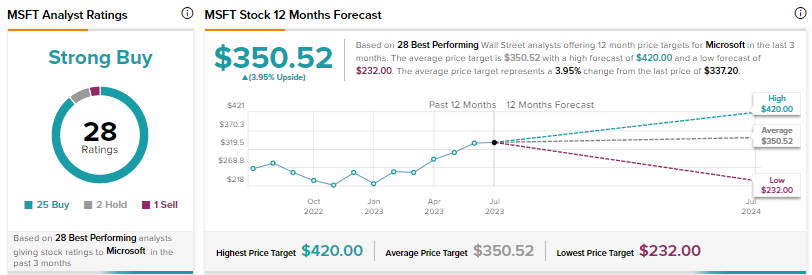

Of the 28 Top Wall Street Analysts covering MSFT stock, 25 have a Buy rating, two have a Hold recommendation, and one has a Sell rating. Overall, the stock earns a Strong Buy consensus rating. It is worth noting that the top analysts have an impressive track record of generating attractive returns from their recommendations. Moreover, top analysts have remarkable success rates.

MSFT shares have rallied 41% year-to-date amid investor optimism around generative artificial intelligence (AI). The average price target of top analysts is $350.52, which implies about 4% upside.