Yesterday, tech stock Micron Technology (NASDAQ:MU) posted its earnings, and on many fronts, it disappointed. Sales were down over half. Consensus estimates were broken — and not in a good way. Also, cash flow dried up like the Euphrates. So, why is Micron up more than 6% in Wednesday afternoon’s trading? Some exciting new signs that recovery is afoot definitely helped.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Yes, the earnings report was butchery, but Micron’s recovery may not be far off. Just ask Barclays (NYSE:BCS) analyst Tom O’Malley, who noted that weakness throughout the spectrum has been what he calls “persistent.” That meant a lower book value for Micron, but it also put Micron in a good position to recover. That’s particularly true as the data center market starts making its comeback in light of growing artificial intelligence (AI) use.

O’Malley was hardly alone on this front, either. John Vinh with KeyBanc noted that the recovery “keep[s] getting delayed” but expects “a return to sequential revenue growth over the next several quarters.” Even Joseph Moore with Morgan Stanley (NYSE:MS), who maintained an “underperform” rating, noted several points that suggest improvement despite the current weakness in demand. He highlighted that Micron has reduced utilization, headcount, and capital expense, all of which address the challenges the company had previously faced and is now successfully overcoming.

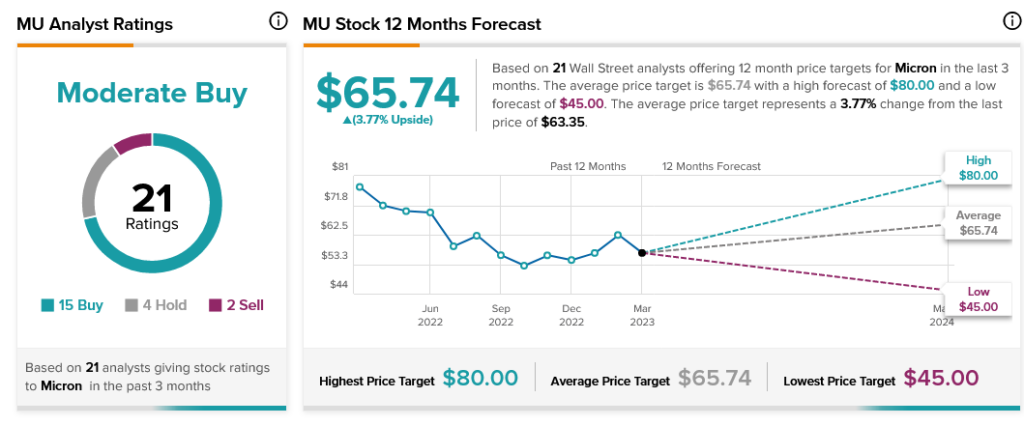

With 15 Buy recommendations to just four Holds and two Sells, Micron stock is considered a Moderate Buy. Micron stock also offers modest upside potential of 3.77%.