Mercado Livre (MELI), a leading Latin American E-commerce and financial services technology company, recently announced the acquisition of Kangu, a Brazilian logistics company. The financial terms of the deal have not been disclosed so far.

Following the news, shares of the company appreciated marginally to close at $1,871.94 in Wednesday’s extended trade.

Kangu’s buyout is in line with Mercado’s strategy of strengthening its logistics network. With over 5,000 collection and delivery points, Kangu serves a diverse range of companies and is expected to boost efficiency for Mercado’s sellers and offer faster deliveries to its thousands of customers.

The Corporate Development Director for Mercado, Renato Pereira, said, “Kangu is already an important part of our ecosystem, with over 5,000 locations connecting Mercado Livre buyers and sellers. The deal will increase operational efficiency and capillarity as we maintain our focus on delivering to Brazilian customers as quickly as possible.” (See Mercado stock chart on TipRanks)

Recently, BTIG analyst Marvin Fong reiterated a Buy rating on the stock with a price target of $930, which implies downside potential of 50.3% from current levels.

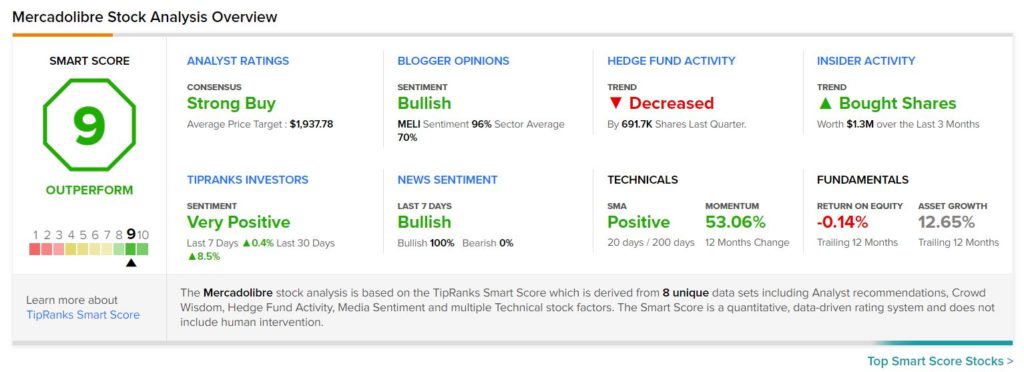

Consensus among analysts is a Strong Buy based on 9 unanimous Buys. The average Mercado price target of $1,937.78 implies upside potential of 3.5% from current levels.

Mercado scores a 9 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained 53.9% over the past year.

Related News:

ManpowerGroup to Acquire ettain group for $925M

Berkshire Hills Bancorp to Sell Subsidiary to Brown & Brown

NVIDIA Launches AI Enterprise Software; Street Says Buy