2023 has begun with a bang for meme stocks as retail investors seem to again have developed a risk appetite for these stocks judging by the strong rally in these stocks. Popular meme stocks like Bed Bath and Beyond (BBBY), Newegg Commerce (NEGG), SmileDirectClub (SDC), and Silvergate Capital (SI) have experienced intense volatility in the past week.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Stocks like AMC Entertainment (AMC) and GameStop (GME) continue to be popular with investors latching on to the meme stock frenzy.

Over the past five trading sessions, BBBY has soared by more than 135% but on Friday, the stock slid more than 30% even as there were reports that the retailer was exploring a sale of its assets. The retailer is on the verge of bankruptcy.

This has excited the meme stock crowd and the short interest in the stock stood at 38.5 million shares as on December 30, 2022. In a meme stock frenzy, retail traders on social media bid up heavily shorted stocks which results in massive short squeezes – a pain for short sellers.

This is because as the stock rises in price, it forces short sellers to buy back their shares at higher prices to limit their losses. This further fuels the stock rally.

However, according to Ihor Dusaniwsky, S3 Partners’ managing director of predictive analytics, the current short interest in BBBY stock is $82.7 million comprising a 52.1% short-interest float.

Dusaniwsky commented that if this BBBY rally continues, “we could see some near-term short sellers exit their positions and begin to pocket (realize) the profits they earned in 2022.”

The managing director added that BBBY stock’s bankruptcy risk “could embolden shorts to hold onto their positions, incur some temporary losses, and wait out this rally in anticipation of a $0.00 stock price in bankruptcy.”

Even Wall Street analysts have washed their hands off BBBY stock and are bearish about it rating it a Strong Sell with six unanimous Sells.

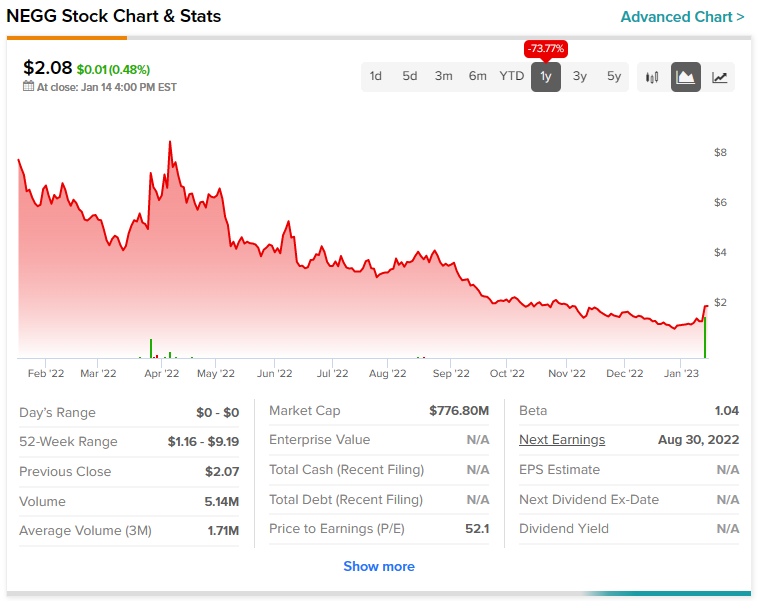

Another stock that seems to have caught the eye of the meme stock crowd is the online retailer of consumer electronics and peripherals, Newegg Commerce (NEGG) which soared by 40.8% on Friday even as this penny stock has tanked by more than 70% in the past year.

One major reason for the rise in the stock has been a spike in short interest.

Silvergate Capital (SI), the cryptocurrency bank is also evincing a keen interest with short interest up in the stock, just ahead of its Q4 earnings on January 17. The stock has tanked by more than 25% in the past month hit hard by the FTX collapse and investors’ exodus from cryptocurrency.

Ihor Dusaniwsky from S3 Partners tweeted about the short interest in SI stock,

Even on Friday, 10.1 million shares of SI stock were traded, almost double the average volume of 5.4 million shares over the past three months.

Analysts are sidelined about SI stock before its Q4 earnings with a Hold consensus rating based on three Buys, five Holds, and two Sells.

Teledentistry company SmileDirectClub (SDC), saw its stock soar by more than 45% on Friday even as there was no significant news about the company.

Over the past five trading sessions alone, the stock has jumped by more than 60%. Over the last year, SDC stock has tanked by more than 65%.

Trading volumes for SDC stock saw a sharp spike on Friday hitting around 30 million shares, far higher than its ten-day average volume of 4.77 million shares.

With these higher volumes and no significant news for the stock, it is possible that traders are looking to benefit from a short squeeze in the stock. At the end of December 30, 2022, short interest in the stock stood at 23.3 million.