U.S. stock indices fell across the board on Oct. 22 as investors digested the latest trade tensions between the U.S. and China, and disappointing corporate earnings from leading companies such as Netflix (NFLX) and Texas Instruments (TXN).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The blue-chip Dow Jones Industrial Average declined 335 points, or 0.71%. The benchmark S&P 500 index finished the trading day down 35 points, or 0.53%. And the technology-heavy Nasdaq index fell 213 points or 1% amid the latest selloff in U.S. equities.

At session lows, the Dow was down more than 400 points, while the Nasdaq decreased nearly 2%. Analysts said that stocks were under pressure after reports surfaced that the U.S. plans to curb exports of American software products to China, a development that could impact everything from laptop computers to jet engines.

Mixed Earnings

At the same time, several prominent technology stocks dropped sharply after they delivered underwhelming financial results for this year’s third quarter. Texas Instruments’ stock closed 6% lower after the semiconductor company’s latest earnings came in weaker than expected.

Shares of Netflix fared even worse, dropping 10% after the streaming service posted a big earnings miss. Other Q3 earnings from companies such as AT&T (T) were mixed, shaking investor confidence in the current rally. Markets are now bracing for more corporate earnings and also the September inflation report that’s due out on Oct. 24.

Some people on Wall Street are raising doubts about the accuracy of the upcoming inflation print given that it’s being released with the U.S. federal government in the midst of a shutdown.

Is the SPDR S&P 500 ETF Trust a Buy?

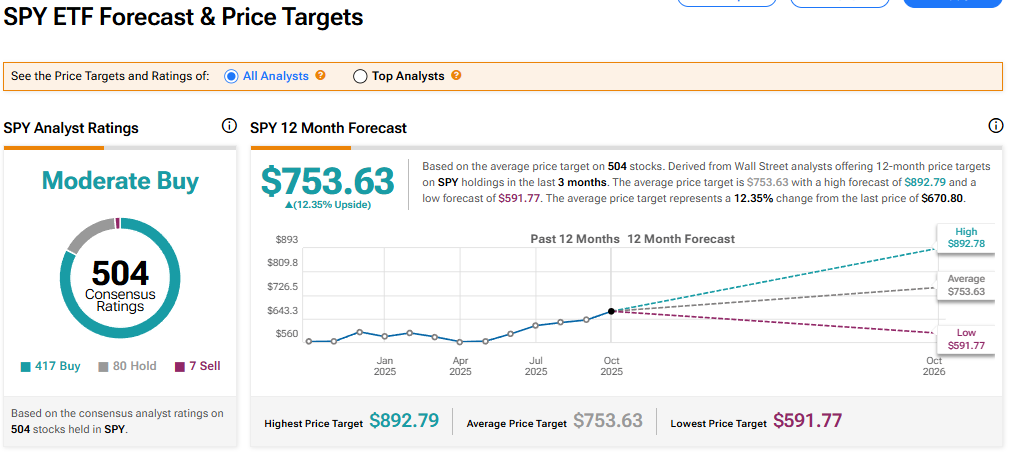

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 417 Buy, 80 Hold, and seven Sell recommendations issued in the last three months. The average SPY price target of $753.63 implies 12.35% upside from current levels.