The administration of U.S. President Donald Trump is reportedly considering placing curbs on software exports to China, including everything from laptop computers to aircraft engines.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The curbs would be in retaliation for Beijing’s ongoing curbs on rare earth exports to the U.S. The plan is reported to be taking shape after President Trump said earlier this month that he would bar “critical software” exports to China and restrict most shipments of items that contain U.S.-based software.

Curbs on software exports could impact major U.S. companies ranging from technology giant Microsoft (MSFT) to aircraft manufacturer Boeing Co. (BA) and electric vehicle maker Tesla (TSLA). The threat of a curb on software exports also comes after Trump threatened to impose 100% tariffs on all Chinese imports effective Nov. 1.

Rare Earths

The Trump administration continues to be angered by China’s restrictions on exports of its rare earth metals, minerals and magnets that are essential components of technologies ranging from smartphones to electric vehicles.

The latest customs data from China shows that U.S.-bound exports or rare earth materials fell 28.7% in September from August to 420.5 tonnes. That figure is nearly 30% lower than a year ago. China continues to have a near-monopoly on the production of rare-earth metals, minerals and magnets with 90% of the global market.

Trade tensions between the U.S. and China continue to escalate, raising the possibility of an all-out trade ware between the world’s two largest economies.

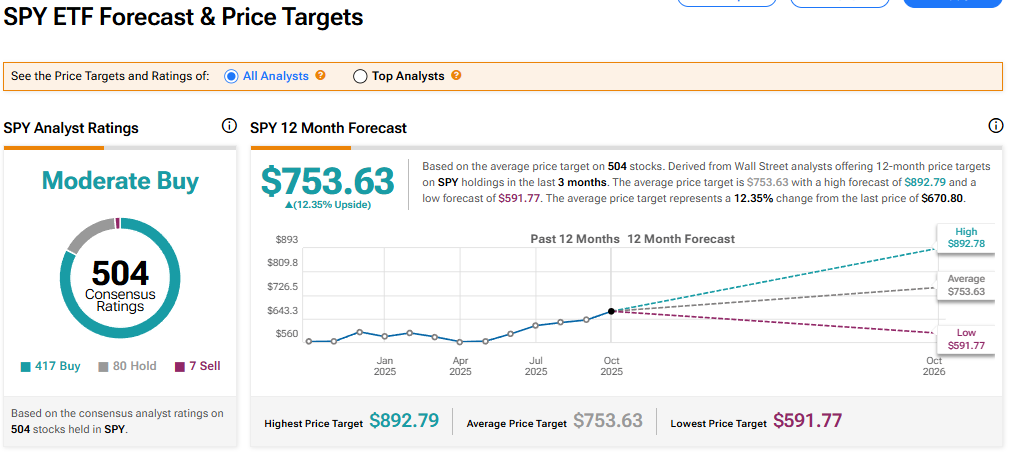

Is the SPDR S&P 500 ETF Trust a Buy?

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 417 Buy, 80 Hold, and seven Sell recommendations issued in the last three months. The average SPY price target of $753.63 implies 12.35% upside from current levels.