A new poll has found that the outlook for interest rates in the U.S. is shifting among economists as we head into 2026.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The latest survey conducted by Reuters (TRI) finds that a majority of economists still expect the U.S. Federal Reserve to lower its trendsetting interest rate by 25 basis points on Oct. 29 and again this December. However, after that, economists are becoming divided on the direction for interest rates.

There is near-unanimous agreement among economists that the U.S. central bank will cut interest rates by 25 basis points in October. However, only 71% of economists anticipate a further 25 basis point reduction in December. And economists are now split seven different ways on where the Fed Funds Rate will be by the end of 2026, ranging from a low of 2.25% to as high as 4%.

Differing Views

In the latest poll, economists say they’re struggling to find clarity given the dearth of economic data that has been available during the current government shutdown in Washington, D.C. Economists are also weighing the risks of elevated inflation and a further weakening of the U.S. labor market.

There is also uncertainty around who will be the next chair of the U.S. Federal Reserve after current Chair Jerome Powell’s term ends in May of next year. President Donald Trump continues to push the central bank to cut rates aggressively. However, 76% of economists who were polled said the biggest risk is that the Fed takes interest rates too low.

The poll was conducted Oct. 15-21 and surveyed a total of 117 economists.

Is the SPDR S&P 500 ETF Trust a Buy?

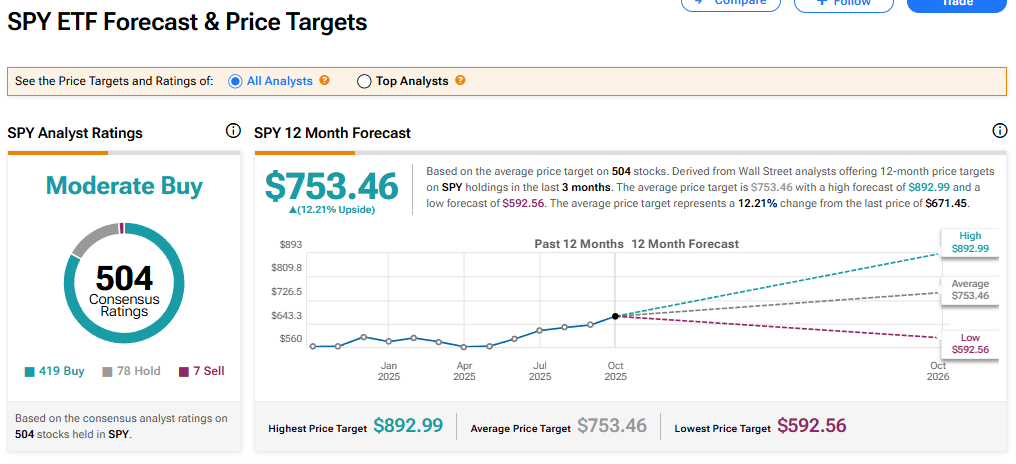

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 419 Buy, 78 Hold, and seven Sell recommendations issued in the last three months. The average SPY price target of $753.46 implies 12.21% upside from current levels.