U.S. stocks closed in the red on Oct. 16 as fears of bad bank loans gripped Wall Street and sent investors running for the exits.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Traders and investors also continue to grapple with trade tensions and an ongoing war of words between the U.S. and China. Consequently, the Dow Jones Industrial Average lost 301.07 points, or 0.7%, to close at 45,952.24. Earlier in the day, the blue-chip index was up 170 points. The benchmark S&P 500 index finished the day 0.6% lower at 6,629.07.

The technology-heavy Nasdaq index fell 0.5% to settle at 22,562.54 on the day. Indices were dragged lower by bank stocks, with regional lenders Zions (ZION) and Western Alliance (WAL) falling 13% and 11%, respectively, after disclosing hefty charges due to bad loans, raising alarm bells on Wall Street. In Western Alliance’s case, it alleges that one of its largest borrowers committed fraud.

Skittish Investors

Analysts say fears of bad bank loans are the latest worry to rattle already skittish investors and send stocks lower. Investors are nervous about high stock valuations, the artificial intelligence (AI) trade running out of steam, a potential all-out trade war between the U.S. and China, and the government shutdown in Washington, D.C.

Now, investors are also having to contend with potential bad loans and credit losses among regional banks. Despite strong third-quarter financial results from the largest U.S. banks this week, Wall Street is on edge following the bankruptcies of two auto industry-related companies that have raised concerns about loose lending practices in the opaque private credit market.

The current market gyrations continue to send the Cboe Volatility Index (VIX), known as Wall Street’s fear gauge, higher. The VIX is now at its highest level since May, while the U.S. dollar index lost nearly 0.5% in trading on Oct. 16.

Is the SPDR S&P 500 ETF Trust a Buy?

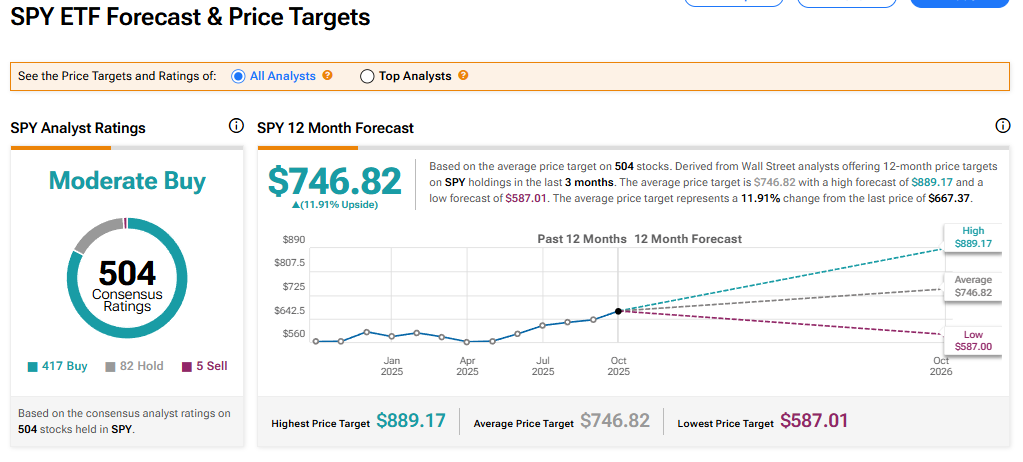

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 417 Buy, 82 Hold, and five Sell recommendations issued in the last three months. The average SPY price target of $746.82 implies 11.91% upside from current levels.