Cisco (NASDAQ:CSCO) completed the acquisition of cybersecurity company Splunk. The move will expand Cisco’s portfolio of software-based solutions. Moreover, the acquisition is positive, adding nearly $4.2 in software annual recurring revenue (ARR). Despite the boost from Splunk, the ongoing macro headwinds continue to limit enterprise spending, posing challenges for the company and restricting the stock’s upside potential in the short term.

Adding to the concerns, Cisco is witnessing weak demand from telecom and cable service provider customers. This could impact the company’s top line in the near term.

Cisco, a leading provider of a diverse array of technology products and services encompassing networking hardware, software, and telecommunications equipment, announced the acquisition of Splunk in September last year. Rosenblatt Securities analyst Michael Genovese, who reiterated a Hold on CSCO stock on February 14, 2024, believes that adding Splunk’s about $4 billion in software ARR could expand CSCO’s multiples. However, the analyst doesn’t see Splunk as the best strategic fit for the company.

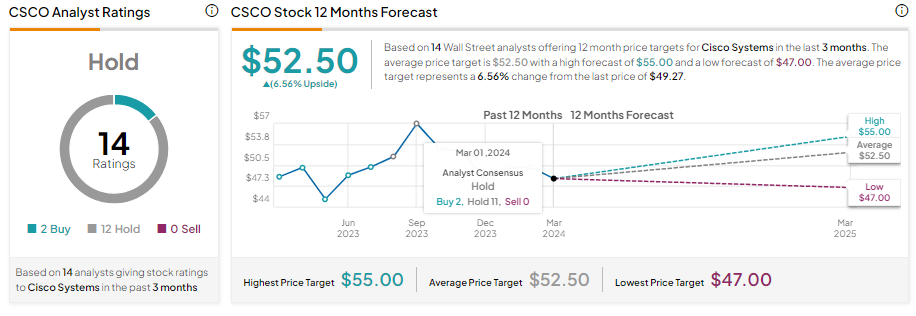

Is CSCO a Buy, Sell, or Hold?

Cisco stock has underperformed the broader equity market and is trading in the red year-to-date. The stock’s underperformance stems from the company’s cautious full-year outlook. Notably, Cisco lowered its full-year revenue guidance twice, citing uncertainty regarding deals amid macro headwinds. Further, CSCO’s adjusted EPS forecast of $3.68 to $3.74 for 2024 fell short of analysts’ consensus estimate of $3.86.

While Cisco stock is down about 1.7% year-to-date, analysts remain sidelined. Further, their average price target indicates limited upside potential from current levels. The stock sports a Hold consensus rating based on two Buy and 12 Hold recommendations. Analysts’ average price target on CSCO stock is $52.50, implying 6.56% upside potential over the next 12 months.