Networking giant Cisco Systems (NASDAQ:CSCO) reported better-than-expected results for the second quarter of Fiscal Year 2024. However, CSCO stock fell 5.3% in after-hours trading on Wednesday. This decline may be attributed to the company’s revised revenue guidance for the full year, which fell short of analyst estimates.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

CSCO reported Q2 adjusted earnings of $0.87 per share, which surpassed the Street’s expectations of $0.84 but decreased 1% year-over-year. Meanwhile, the company’s revenues fell by 6% to $12.8 billion. The fall in revenues is primarily due to lower Product revenue, partly offset by higher Service revenue. Nevertheless, the top line came in higher than the consensus estimate of $12.71 billion.

In terms of other metrics, total annualized recurring revenue (ARR) increased 6% year over year to $24.7 billion. Moreover, remaining performance obligations came in at $35.7 billion, up 12%.

Q3 and Fiscal 2024 Outlook

For the fiscal third quarter, the company expects revenues to come in the range of $12.1 billion to $12.3 billion, which is below the analysts’ consensus estimate of $13.09 billion. Furthermore, it predicts that EPS will be in the range of $0.84 to $0.86, below the $0.92 per share estimate.

Cisco lowered its full-year revenue guidance. It now expects revenues to be in the range of $51.5 billion to $52.5 billion, down from the earlier range of $53.8 billion to $55 billion. Meanwhile, adjusted earnings are expected to be between $3.68 and $3.74 per share, lower than the consensus estimate of $3.86.

Other Major Updates

Alongside earnings, CSCO announced a 3% increase in quarterly dividends to $0.40 per common share. The dividend will be paid to stockholders of record as of the close of business on April 4, 2024. It is worth mentioning that Cisco has an impressive dividend yield of 3.12%, above the technology sector’s average of 1.03%.

Additionally, the company disclosed plans to lay off about 5% of its global workforce as part of its broader restructuring plan and expects to incur charges of about $800 million. The majority of these costs are expected to occur in the fiscal third quarter.

Is CSCO a Buy or Sell?

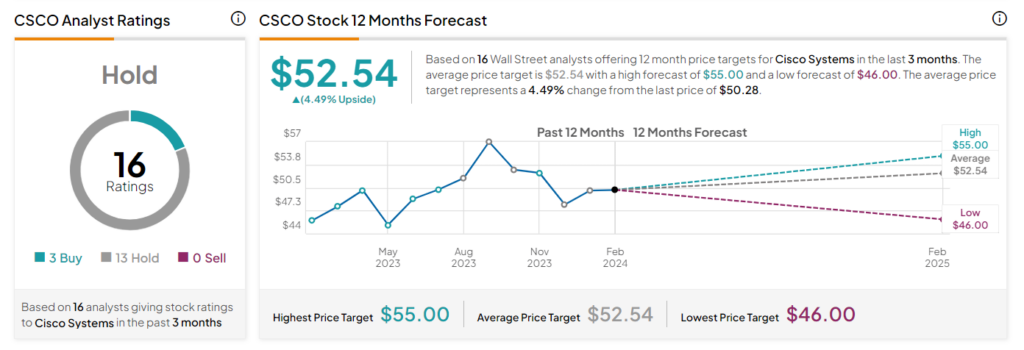

On TipRanks, Cisco stock has a Hold consensus rating based on three Buy versus 13 Hold ratings assigned in the past three months. The average Cisco stock price target of $52.54 implies 4.49% upside potential from current levels. Shares of the company have gained 6.9% in the past year.