Envestnet (NYSE:ENV) stock closed 9.3% higher on buyout rumors. According to Reuters, the financial technology company is exploring options, including a potential sale. This decision comes amid indications of interest from potential acquirers. Private equity companies, such as Bain Capital, are reportedly seeking to acquire Envestnet.

Envestnet is working with investment bank Morgan Stanley (NYSE:MS) to engage with potential buyers.

The company provides comprehensive wealth management software, services, and solutions to financial advisors.

Price Performance

Envestnet has been focusing on cutting expenses and investing in new products. The stock is up about 25% year-to-date and 45% over the past six months.

The company will release its first quarter 2024 financial results on Tuesday, May 7.

ENV Stock: Q1 Expectations

Wall Street expects ENV to post revenue of $324.87 million in the first quarter of 2024, up about 8.7% year-over-year. Further, analysts’ consensus estimate is within management’s guidance range of $320 million to $326 million.

Meanwhile, analysts expect ENV to post earnings of $0.55 per share, up from $0.46 in the previous year’s quarter. Higher sales and efforts to expand margins will likely cushion its bottom line.

What Is the Price Prediction for ENV?

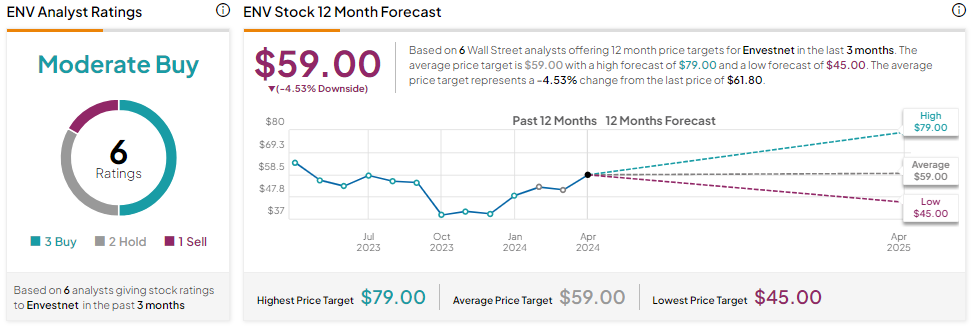

Ahead of the Q1 earnings print, Wall Street is cautiously optimistic about ENV stock. The stock has three Buy, two Hold, and one Sell recommendations for a Moderate Buy consensus rating. Analysts’ average price target on ENV stock is $59, implying 4.53% downside potential from current levels.