Chinese eCommerce major Coupang (NYSE:CPNG) is acquiring the business and assets of British luxury fashion platform Farfetch (NYSE:FTCH). The announcement has sent Farfetch shares nearly 35% lower today.

This strategic M & A move is expected to make Coupang a leading name in the $400 billion global personal luxury goods market. The transaction will combine Coupang’s operational and logistics prowess with Farfetch’s expertise in the luxury market. Further, CPNG aims to make inroads into the lucrative luxury goods market in South Korea with this move.

Under the agreement, Farfetch gets access to $500 million in the form of a bridge loan. For Farfetch, the deal comes after its attempts to secure additional liquidity failed to yield any results, making its ability to remain a going concern uncertain. Further, its deal to acquire a 47.5% stake in Yoox-Net-A-Porter (YNAP) with Richemont and Symphony Global has been terminated. Richemont is the owner of Cartier.

Moreover, holders of Farfetch’s convertible debt, as well as Class A and B shares, will not be able to recover any of their outstanding investments in the company. FTCH is expected to be delisted from the NYSE and liquidated.

What is the Forecast for CPNG?

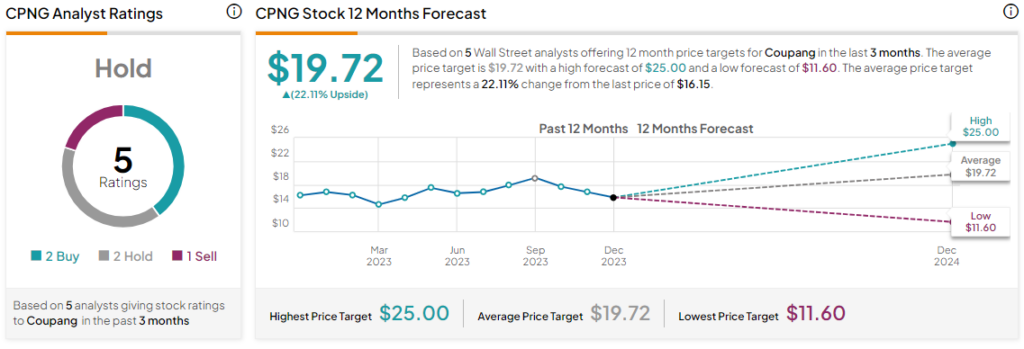

Today’s decline in Farfetch shares adds to the 84% value erosion in the stock over the past year. On the other hand, Coupang shares have gained nearly 9% so far this year. Overall, the Street has a Hold consensus rating on Coupang and the average CPNG price target of $19.72 implies a 22.1% potential upside in the stock.

Read full Disclosure