Shares of luxury fashion platform Farfetch (NYSE:FTCH) are surging today after European authorities approved its stake purchase in Yoox Net-A-Porter (YNAP) from Richemont, the owner of Cartier.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This was the final regulatory hurdle for the deal to proceed. However, the two companies are still working toward fulfilling certain other closing conditions, and further details are awaited.

The deal, which was announced last year, involves Farfetch acquiring a 47.5% stake in YNAP in exchange for 50 million of its shares. Farfetch can potentially acquire the rest of YNAP via an option arrangement. This major regulatory win for Farfetch comes at a time when U.S. retailers are reducing orders and more of Farfetch’s inventory is coming from brands instead of wholesalers, as reported by Reuters.

Despite rising revenues over the past four years, Farfetch has yet to turn a profit. Investors have witnessed the value of their Farfetch holdings plummet from a high of nearly $74 in February 2021 to the current level of $1.8.

What Is the Price Target for FTCH?

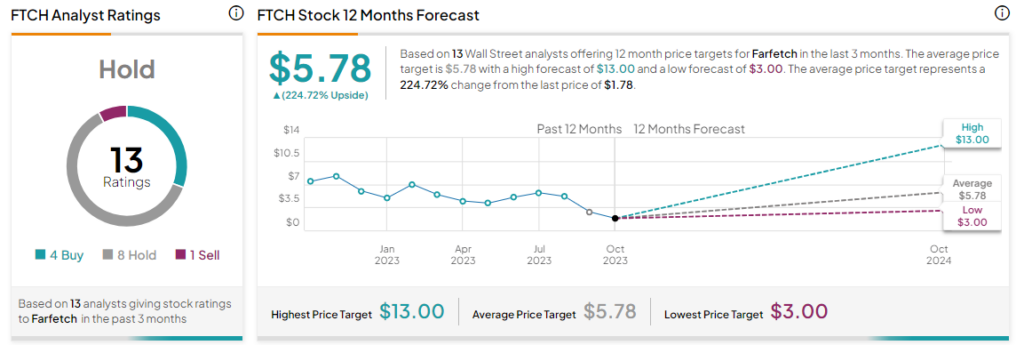

Overall, the Street has a Hold consensus rating on Farfetch. The average FTCH price target of $5.78 implies an eye-popping 224.7% potential upside.

Read full Disclosure