Lyft (NASDAQ:LYFT) has named its director David Risher, a former Amazon (NASDAQ:AMZN) executive, as its new CEO, as the ride-hailing company struggles to compete with bigger rival Uber (NYSE:UBER). Co-founders Logan Green and John Zimmer will step down as CEO and president, respectively. Lyft shares were up over 4% in pre-market trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The co-founders have decided to relinquish their full-time executive management positions, with Green assuming the role of non-executive chairman of the board and Zimmer taking up the role of vice chair, effective April 17 and June 30, respectively. Sean Aggarwal, current Lyft board chairman, will transition to the role of lead independent director.

The appointment of Risher as Lyft’s new CEO will become effective on April 17. Risher is a highly experienced technology executive who previously served as Amazon’s first head of product and head of U.S. retail, and as a general manager at Microsoft (MSFT). He then co-founded Worldreader, a non-profit organization that helps children in under-served communities gain access to digital books.

It is worth noting that Risher has been serving as a director on Lyft’s board since July 2021. He will receive an annual salary of $725,000 and a signing bonus of $3.25 million.

New CEO to Revive Business

Compared to Lyft, rival Uber bounced back more quickly after the reopening of the economy, thanks to its global presence and food delivery service. “One of the first things we’re very focused on is making sure we are matching Uber on price,” said Risher in an interview, per Reuters.

Citing data from market research firm YipitData, the Wall Street Journal noted that Uber now holds 74% of the U.S. ride-share market, up from 62% in early 2020. In comparison, Lyft’s market share has declined to 26% from 38% over the same period.

Risher also made it clear that Lyft would not get into food and grocery delivery. “The last thing they want is to get into a car that just dropped off a pizza. I think that’s a business model that may or may not be ultimately very customer-friendly.”

Last month, Lyft shares tanked as the company’s weak first-quarter revenue guidance spooked investors. The company blamed seasonality and lower prices for its poor Q1 2023 outlook.

Is LYFT Stock a Buy, Sell, or Hold?

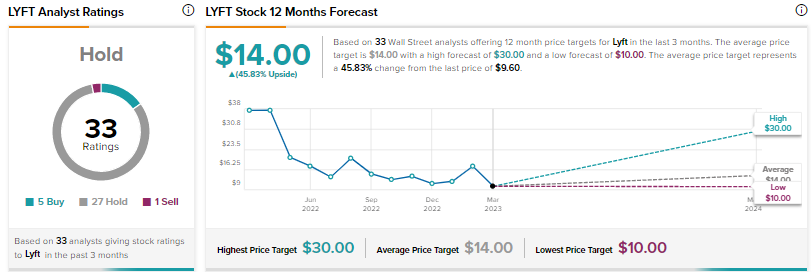

Wall Street is sidelined on Lyft stock, with a Hold consensus rating based on five Buys, 27 Holds, and one Sell. The average price target of $14 suggests nearly 46% upside. Lyft shares have declined 13% since the start of this year. In contrast, Uber shares have risen about 24% year-to-date.