Energy stocks have taken their fair share of knocks this year but may still have plenty of gas left to ignite investor interest.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Despite a fossil-fuel friendly President returning to office in January, Trump’s ‘Drill, Baby, Drill’ mantra has failed to offset a glut of fears in the oil and gas sector. These include volatile oil supply, given that much of it is controlled by the Organization of the Petroleum Exporting Countries, such as Saudi Arabia, the impact of geopolitical events including the Israel-Iran war and tariffs.

The continued shift to renewable energy worldwide and general economic uncertainty has also bashed demand.

Major energy stocks have responded by looking inwards to save costs and boost efficiencies. Earlier this week Exxon Mobil (XOM) said it was laying off 2,000 workers around the globe representing about 3% to 4% of its overall workforce.

In addition, Canadian shale producer Imperial Oil, in which Exxon is a major shareholder, announced plans to cut 20% of its workforce and shutter business in Calgary.

Chevron (CVX) plans to lay off 15% to 20% of its global workforce, while BP (BP) has said it would cut more than 5% of its jobs. ConocoPhillips (COP) has also announced it will cut 20% to 25% of its jobs.

Indeed, according to Texas labor market statistics, U.S. oil and gas production jobs fell by 4,700 in the first six months of this year.

Activity levels in the key U.S. producing states of Texas, Louisiana and New Mexico also declined slightly in the third quarter, with several industry executives reporting significant delays in investment decisions in response to price volatility.

Share Price Struggle

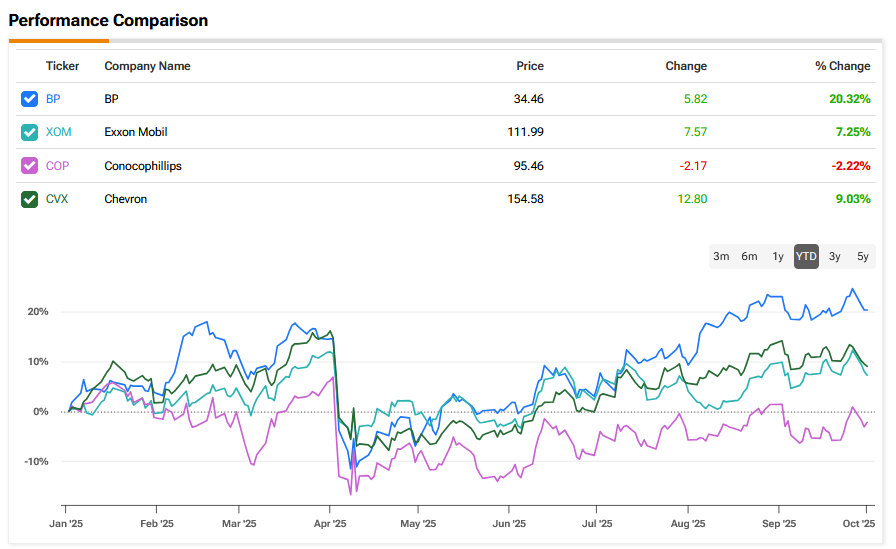

Accordingly, share prices in the sector have struggled over the last 12 months. Exxon Mobil has eked out a 7% gain, with Chevron up 10% and ConocoPhillips down 2%. BP, which shifted focus from renewable energy back to fossil fuels this year, has climbed 21% but even that pales in comparison with other stock sector rallies this year.

AI technology stocks have been the main gainers but even closer to home hard assets such as gold mining stocks have shone on the higher price of the precious metal.

With those soaring share prices come soaring valuations and nosebleed high PE multiples. Perhaps too hot given the recent moves of wise sages such as investor Warren Buffett.

His Berkshire Hathaway ($BRK.B) investment group has sold $177 billion worth of stocks in the last 11 quarters but retained $344 billion in cash and U.S. Treasury bills on its balance sheet.

The most likely reason for keeping the cash on the sidelines is that Buffett can’t find stocks to buy because of elevated valuations.

The S&P 500 over the last month had an average Cyclically Adjusted Price-to-Earnings ratio (CAPE) of 38 which is an unusually high valuation. Indeed, looking back in time the index has recorded a monthly CAPE ratio higher than 37 just 41 times since its inception in 1957. It is often an indicator that the S&P 500 is heading for a decline.

Energy stocks are not contributing to these strikingly high levels. Exxon Mobil has a PE ratio of 16.2 with Chevron at 20.1. Compare that to semiconductor giant Nvidia (NVDA) with a ratio of 50.

The SPDR Energy Select Sector Fund (XLE), whose holdings include major oil and gas firms, has a PE of 8.87 making it the only SPDR fund with a single-digit ratio.

Energy Encouragement

Investors, however, should take some encouragement from these numbers. Like Daniel Day-Lewis in the film ‘There Will Be Blood’ or James Dean in ‘Giant’, their long wait for oil stocks to turn into a ‘gusher’ could be equally as dramatic.

“Energy stocks have absorbed lots of bad news without breaking down,” said David Russell, Global Head of Market Strategy at TradeStation. “With other hard assets like metals rallying, investors frustrated by high valuations in other parts of the market may see opportunity in low-multiple oil and gas names.”

There are some encouraging drivers for a lighting up of energy stocks.

Recent U.S. Energy Information Administration (EIA) data showed that in July U.S. total liquids output hit a better-than-expected record 21.218 million barrels per day, nearly 500,000 bpd higher than the agency’s weekly estimates had implied. Crude production came in at 13.642 million bpd, with natural gas liquids at 7.577 million bpd.

The upward revision wasn’t just on the supply side. EIA pegged total product supplied, its proxy for demand, at 20.984 mb/d, some 344,000 bpd higher than weekly data had suggested. Gasoline, diesel, and jet fuel consumption all moved higher meaning lower inventory levels – essentially less oil sloshing around in storage tanks.

This demand hike should maybe not have been a surprise. Despite some fears over a U.S. and global slowdown, U.S. GDP rose at an annualized rate of 3.8% from April through June. That’s significantly higher than the 3.3% rate reported in the second estimate and was driven by an uplift in consumer spending.

The OECD also recently raised global growth estimates for 2025 to 3.2%, up from a previous prediction of 2.9%. It was as a result of surprisingly resilient global growth in the first half of 2025, although it did caution that the full impact of Trump’s tariffs could be yet to come, while inflation could also weigh on growth.

Inflation in the US is certainly higher than hoped at around 3%. But even that could be attractive to energy investors given that it is a traditional inflation hedge.

The XLE currently has a yield of 3.17% beating inflation. “XLE is the only sector fund that hasn’t made a new all-time high this decade. That also highlights the potential value thesis,” said Russell.

Supply Support

Supply drivers are also more in favour for energy investors. OPEC+, which produces 50% of global oil and brings together OPEC and allies such as Russia, recently said it has been pumping almost 500,000 barrels per day below its targets. The shortfall, equal to 0.5% of global demand, has defied market expectations of a supply glut and supported oil prices.

“Everyone has expected an oil glut as OPEC+ resumes production. However, supplies have been tighter than hoped and geopolitical risks are lingering,” Russell said.

China, according to a Goldman Sachs (GS) report, is also looking to accelerate crude stockpiling this year taking advantage of lower prices and prioritising energy security.

The bank projects the country will add about 500,000 barrels a day to its reserves over the next five quarters, a pace well above recent estimates of Chinese buying.

That means less supply meeting higher demand and a likely price boost. U.S producers upping their output are likely to benefit.

“No recession news is good news for a cyclical group like energy,” said Russell. “Energy is a cyclical sector that can benefit from the kind of strong economy that’s taking shape despite fears of slowdown. These names seem under owned by many big investors.”

Slick Stocks

So which stocks are likely to prosper?

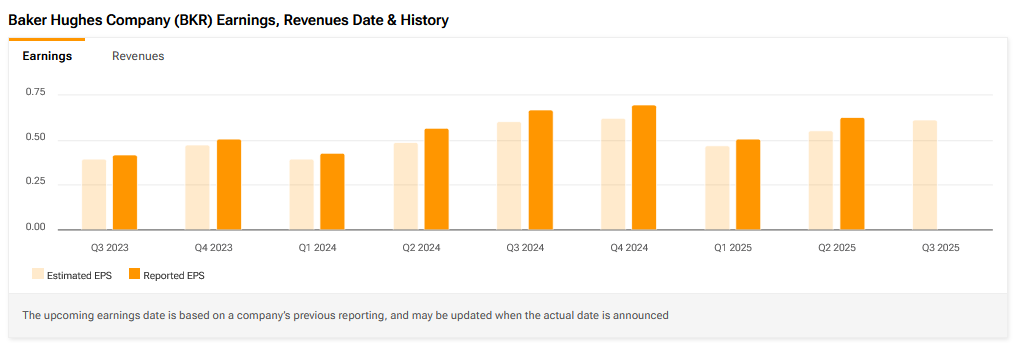

Russell says aside from the obvious name such as XOM and CVX, investors could also consider energy technology company Baker Hughes (BKR) which is benefiting from the growth of AI.

In its second quarter it revealed Industrial and Energy Technology orders totaled $3.5 billion, supported by more than $550 million of data center related orders.

“Due to surging demand for generative AI, we see increasing opportunities for our power generation solutions to support behind-the-meter power requirements for data centers,” said Ganesh Ramaswamy, executive vice president of Industrial & Energy Technology at Baker Hughes, back in March.

In May, Frontier Infrastructure said it had acquired 16 natural gas turbines from Baker Hughes to power planned data center projects across Wyoming and Texas.

Other names also linked to natural gas for power generation include EQT (EQT), Expand Energy (EXE) and Comstock Resources (CRK).

EQT, whose share price is up 19% this year, generated high operating revenues in its last reported quarter, 2Q25, of $2.56 billion. This figure was up an impressive 167% year-over-year, reflecting both strong sales and strong pricing.

“We expect shares to continue to re-rate as management executes on further deleveraging, delivery of ‘upside’ synergies which are advancing ahead of plan, and strategic growth, including execution on recently announced midstream & power opportunities,” said Devin McDermott, analyst at Morgan Stanley.

Such glowing endorsements could become the norm for energy stocks in the next few months.

Russell said: “Investors uncomfortable with high multiples in AI stocks might see value in energy stocks, which are pricing worst-case scenarios that might not play out.”