If you’ve noticed that food prices are a lot higher than what they were, say, a few months ago, then congratulations: you’ve likely been shopping for food in the last few months. How to address that is on a lot of minds, but Loblaw (TSE:L) isn’t convinced that one plan, a grocery code of conduct, is the way to solve things.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Loblaw’s chairman, Galen Weston, appeared before the agriculture committee of the House of Commons to make his case known: the code of conduct, as proposed, might actually do more harm than good. Grocers like Loblaw, as well as Walmart (NYSE:WMT) Canada, are working to help stabilize food prices.

Weston noted that the basics of the code, as presented, are sound enough, but attempting to do too much too soon may have the opposite effect: not only high prices but also empty shelves. The code of conduct is specifically designed to address the relationship between grocers and their suppliers, which is one key point of contact that influences what shoppers pay for goods.

Is the Status Quo Working?

Reports from Loblaws note that it’s already been working to lower prices and has seen “meaningful” drops on various staple goods that make up about 10% of its overall chain sales. This means, unfortunately, that 90% of its overall sales have seen no movement or upward movement. That, in turn, means nothing good for the consumer. The problem likely isn’t at the grocery store level but at the supplier level. Farmers, after all, have been fending off frantically escalating costs on everything from fertilizer to fuel to, yes, even labor for years now. Looking to grocery stores to fix a problem at the supplier level is like expecting your congressman to fix your snowblower. It might look like it would work, but you’ll probably be disappointed with the results.

Is Loblaw a Buy, Sell, or Hold?

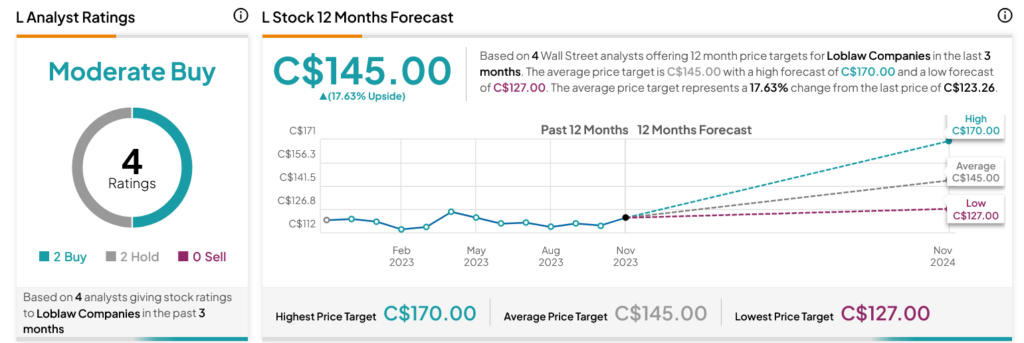

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:L stock based on two Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 0.34% rally in its share price over the past year, the average TSE:L price target of C$145 per share implies 17.63% upside potential.