Give supermarket chain Loblaw Companies (TSE:L) some credit; they turned in a pretty impressive third-quarter earnings report. But despite this—and some noteworthy new plans to expand the market—investors punished it by sending shares down just over 2% in Wednesday afternoon’s trading.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Loblaw Companies brought in C$18.265 billion in revenue, which was up around 5% year-over-year. Food Retail same-store sales gained 4.5%, and Drug Retail same-store sales increased by 4.6%. Even its online sales were up, surging 13.6%. Reports note that this resulted from two key factors: one, a conscious effort to focus on driving sales growth, and two, rampant inflation in food costs. There were improvements in buying, certainly, but the recent rises in inflation drove revenue figures up as well. Furthermore, personalized offers and an increased pursuit of private label brands chipped in on growth.

Soaring Inflation wasn’t the Only Assist

Loblaw definitely benefited from inflation, but give it its due: it drove at least some of its own success. It recently opened its 150th “discount Maxi location,” which makes it clear it’s working to provide value to its customers. It’s also been working to expand its connections to new suppliers that can provide value thanks to its “Small Supplier Program.” The Small Supplier Program opens up the Loblaw door for more locally sourced and smaller-batch goods to reach its shelves. Loblaw offered up extra resources to over a thousand such operations, from growers and bakers to even wine-makers. That should expand its offerings and give Loblaw customers an extra reason to shop there.

Is L Stock a Good Buy Right Now?

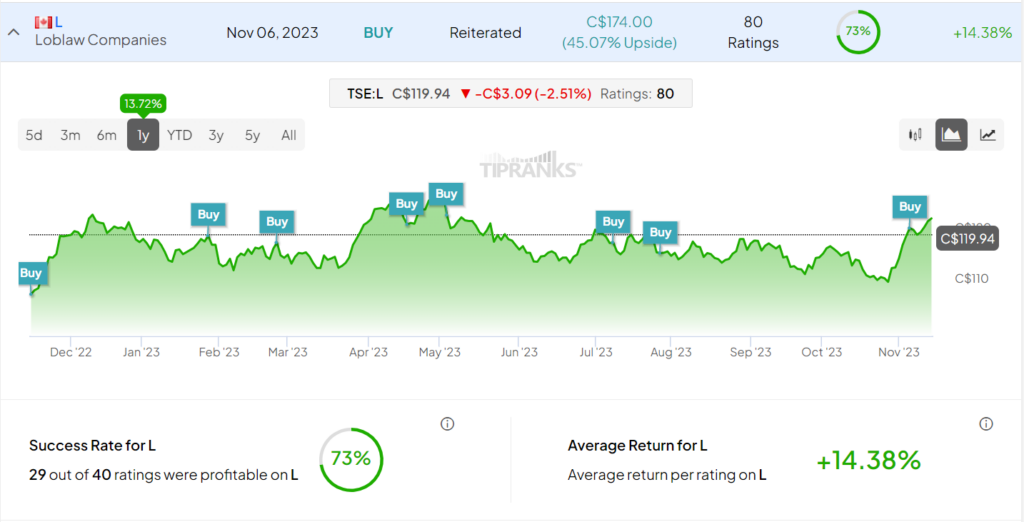

Turning to Wall Street, top-rated analyst Irene Nattel has a Buy rating and C$174 price target on Loblaw stock. After an 11.3% rally in its share price over the past year, this implies over 45% upside potential. Historically, Nattel has had a 73% success rate on her L stock recommendations, with an average return of 14.38% per recommendation.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue